Please note that the Timing 10 returns have changed. We had inadvertently posted the returns of the previous version of the strategy during the past two months. That has been corrected.

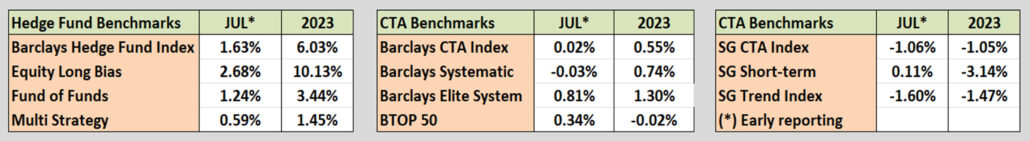

Industry Benchmark Performance

Industry gains for equities in July but lagging far behind the gains of the major index markets. It is understandable that funds are waiting for the trends to become clear. CTAs are also having a difficult time. Most markets have quieted, including interest rates and currencies, usually the ones contributing most to returns. We are in a “wait-and-see” mode.

Kaufman’sMost Popular Books (available on Amazon)

Trading Systems and Methods, 6th Edition. The complete guide to trading systems, with more than 250 programs and spreadsheets. The most important book for a system developer.

Kaufman Constructs Trading Systems. A step-by-step manual on how to develop, test, and trade an algorithmic system.

Learn To Trade. Written for both serious beginners and practiced traders, this book includes chart formations, trends, indicators, trading rules, risk, and portfolio management. You can find it in color on Amazon.

You can also find these books on our website, www.kaufmansignals.com.

Blogs and Recent Publications

Find Mr. Kaufman’s other recent publications and seminars at the end of this report. We post new interviews, seminars, and reference new articles by Mr. Kaufman each month.

July Performance in Brief

Most of our programs had good returns in July and are now looking good for the year. Our benchmark 10-stock Trend program is lagging slightly behind the S&P but then we have risk controls which requires some caution. The Timing program is doing better now that we have corrected the tracking results. We had not changed over to record the results of the new model when we activated it a few months ago.

Futures have made a good recovery after being beaten up by the 3-month Eurodollar. We have reduced the risk for that market but it seems to have stabilized. Returns are better than the industry, so we are optimistic.

Major Equity ETFs

July shows more gains and a steady uptrend in all the equity ETFs. NASDAQ is now up by a remarkable 44% this year, and the S&P higher by 20%. The DOW is the laggard after resisting the decline in the other index markets. With the NASDAQ low in January, this chart may be showing the long-term bottom.

CLOSE-UP: Cryptos – Risks and Rewards

There is a lot going on in the world of cryptocurrencies, some of it good, some not so good. In general, the good has to do with opportunity and the bad with risk. That sounds like most of trading, but there are important differences. You will need to decide if the reward is worth the risk. But first some background.

What Is a Cryptocurrency?

The first cryptocurrency was Bitcoin, which appeared in January 2009 by a group using the name Satoshi Nakamoto. No one knows who or what they are.

A cryptocurrency, or crypto, is called a digital currency. It has no physical representation except in pictures. The proponents claim that people need their own money, not controlled by the government. It is intended to eliminate the need for traditional intermediaries, such as banks, when funds are being transferred between two parties. Something like B2B (business to business).

After Bitcoin, Ethereum, Dogecoin, and others followed. At the current count, there are about 23,000 cryptos, created in dozens of countries.

El Salvador and Cuba recognize Bitcoin as legal tender. Elon Musk has been on-and-off about allowing customers to buy a Tesla using Bitcoin. On the other hand, China has banned the use of cryptos as well as the verification process known as mining.

Creating a Cryptocurrency

Anyone can create a cryptocurrency. You need to keep track of all the transactions, which is done in a process called “blockchain.” It can require a large about of programming and support, but there are no regulations (as far as I know) governing the process and no financial requirements.

Blockchain

Crypto transactions are recorded using a process called blockchain. It records all data needed to identify each transaction and is kept permanently. It is said to be resistant to modification. It is interesting that each block is verified by a process called mining, which is computer intensive, so much so that some cities have banned mining because of the drain on their power grid.

Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

The blockchain concept has been embraced by a number of major companies as a better way to track transactions.

Gold, Diamonds, and Cryptos as a Store of Value

What makes a bitcoin worth $30,000? But then what makes gold worth $1,900/ounce? It is how we value it. Only 11% of gold has industrial use, the rest is kept in different forms simply as a store of value (see Chart 1).

Chart 1. Usage of gold.

And diamonds? We know that there are large quantities of diamonds, but the miners control the output to keep prices high. 80% of diamonds are used in industry for drilling and abrasive work. But those are chips, not the ones we see in engagement rings. Large diamonds are valuable because people think they are valuable.

Why not cryptos? Gold and diamonds have a physical presence. You can hold them, make jewelry. People have accepted them as a store of value for centuries. It is possible that cryptos will achieve that status someday.

But is there one crypto that defines the product? Why should I buy Bitcoin and not Dogecoin? Is one better than the other? We will look at that in the section “Trading Cryptos.”

Crypto Exchanges

There are a number of companies that facilitate trading in cryptos, although most any brokerage firm can do that. The most recognized U.S. firm is Coinbase (COIN). You may have heard of Binance but it is not available to U.S. investors. A crypto exchange allows you to trade between cryptocurrencies.

The Wallet

To trade cryptos through COIN you need an electronic wallet. Using this wallet, where you have deposited funds and access with a private key, you can buy and sell cryptos. You will need to understand how to protect your wallet before trading.

Because the price of Bitcoin is about $30,000, most investors and traders buy and sell fractional amounts. It is similar to the U.S. dollar. We can trade in cents rather than dollars. Bitcoin can trade in “satoshis” valued at $0.01, rather than the full current price of $30,000.

Fraud and Regulation

Cryptocurrencies are unregulated. They have not been officially declared a “security,” so they are not subject to SEC rules. That means they are not audited and there are no financial requirements to trade them. More important, there are no guarantees that your investment is safe. As mentioned earlier, anyone can start a crypto with no financial backing.

There are multiple ways that your investment is at risk. If you scan the internet you will find cases of hacking, where investor money has disappeared from their wallet and from the crypto company itself.

There is also fraud. FTX, one of the largest crypto firms, is under investigation for the misuse of funds. But is it “misuse” when they never said how they will use it and you opened an account without understanding that they had full access to your money? There were never any guarantees.

The Chicago Mercantile Exchange (CME) has a crypto futures contract, BTC. They guarantee that they match the buyers and sellers and reconcile trades. They have regulations that require brokers to check the financial status of traders and provide sufficient margin to cover losses. They do not guarantee the underlying product, but because there is cash delivery, the product is not an issue. It is the same as the settlement of the S&P futures contract. However, the volume is low because it trades in contracts, which are 5 Bitcoins, now valued at a total of $150,000.

The Worst-Case Scenario

What happens if Bitcoin disappears? The value of BTC goes to zero. I believe that the sellers profit and the buyers are broke. It will all be tied up in lawsuits indefinitely. But is it possible for Bitcoin to go to zero?

Hypothetically speaking, the value of a cryptocurrency can go to zero. However, due to the popularity of Bitcoin, it is likely that some traders will find a collapse as a trading opportunity, preventing it from going to zero. It has no intrinsic value as does gold. It is entirely driven by the opinions of buyers and sellers.

Trading Cryptos: Trends, Mean Reversion, and Arbitrage

You still want to trade cryptos because Bitcoin might go from the current value of $30,000 to $1 million, a gain of 3,000%, or so they say.

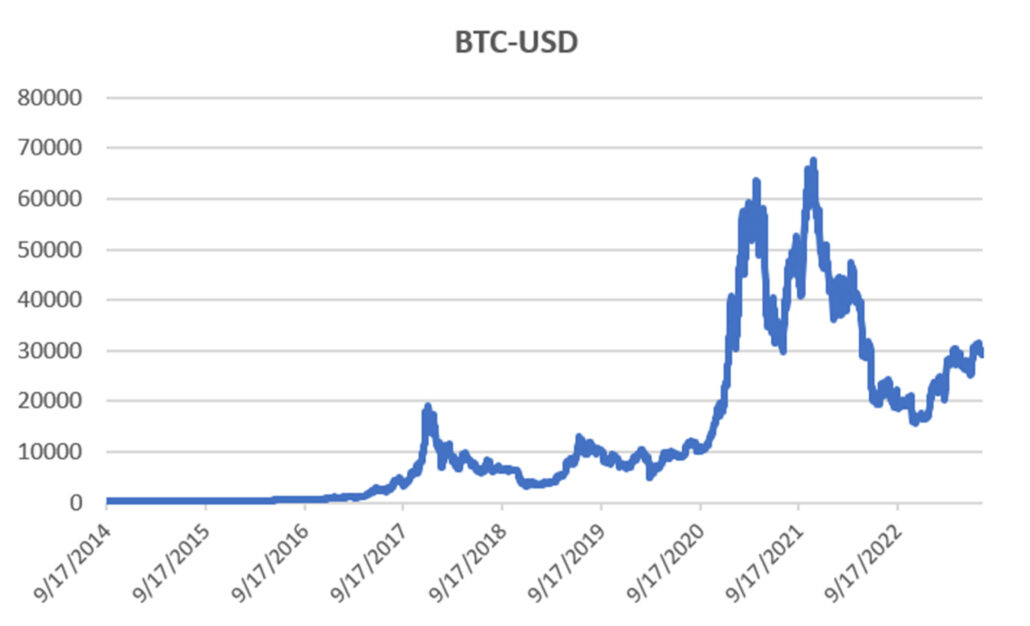

First, let’s look at the BTC-USD (Bitcoin) price history, shown in Chart 2. It started trading on 9/14/2014. It does not pay dividends. It is true that those traders who were in early likely had large profits when prices reached nearly $70,000. If they cashed out. Then prices dropped to $30,000, rallied to their highs, then dropped under $20,000. Prices are now at about $30,000. Even here, someone who bought early did very well.

Chart 2. BTC-USD price history.

If we rescale the three cryptos, setting January 2017 to 100, we can see that there is a similarity in the patterns (Chart 3). In fact, since 2021 BTC and DOGE seem to track closely. That argues for stability and possible arbitrage. Only the volatility seems different.

Chart 3. Price history of BTC, DOGE (left scale), and ETH (right scale)

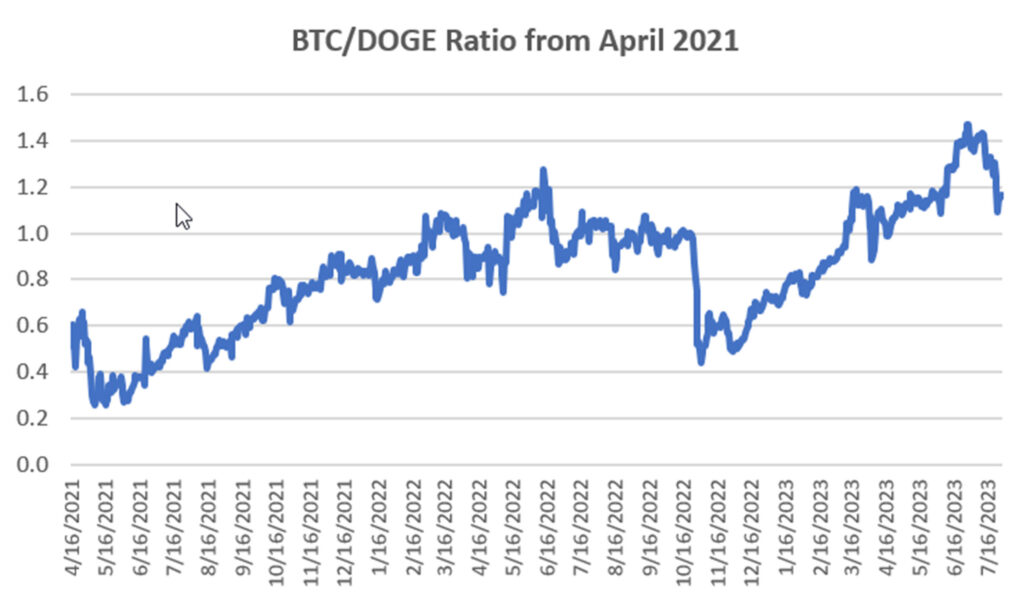

In Chart 4 we see the ratio of BTC to DOGE from 2021, which we thought could be an arbitrage opportunity. But the values do not go back and forth across 1.0 with any regularity. They appear to have short-term trends. That is not an arbitrage pattern.

Chart 4. BTC/DOGE price ratio from 2021.

An important feature of price discovery is the way futures and cash prices relate. Using the S&P futures as an example, when futures prices and the cash SPX drift apart, you can buy the stocks and sell the index, or the opposite, and keep the prices in line.

There is no equivalent with cryptos. Each cryptocurrency is unique. Their price movement depends entirely on the opinion of the buyers and sellers. A crypto in Japan might be going up while one in the U.S. is going down. As we saw in Chart 3, there is a similarity but no arbitrage and no requirement than any one crypto relates to another.

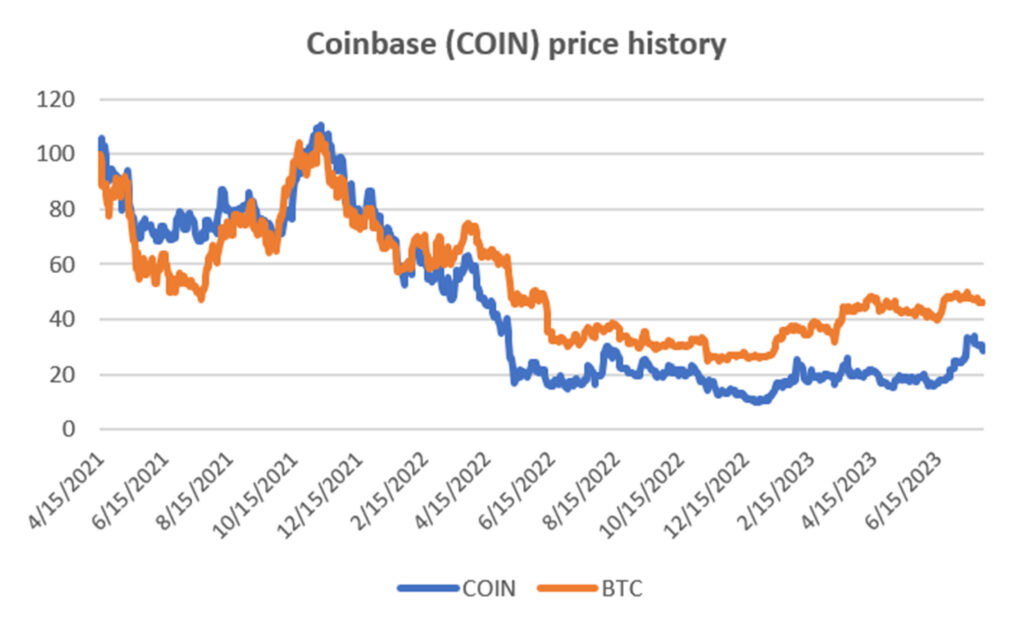

Trading the Exchange (COIN)

Coinbase (COIN) is a public company trading on NASDAQ beginning in April 2021. While it began trading at $325 per share, Chart 5 has been adjusted to 100 at inception so it is easier to see how it relates to Bitcoin. And it does. When BTC rallied, so did the price of COIN. As BTC has quieted at $30,000, so has COIN. If any two markets have an arbitrage opportunity, these seem to be the ones.

Chart 5. Prices of COIN and BTC adjusted to 100 in April 2021.

The Future of Cryptocurrencies

Gambling seems to be a global pastime. We bet on every type of sport. We go to casinos. We buy lottery tickets. Why not cryptos?

But, in my opinion, to see it as more than gambling is a mistake. There is no fundamental basis for the price moves in cryptos. It does not go up when the economy goes down. It does not go down when the dollar goes up. It has no relationship to anything other than the whim of the investors. But human nature has a pattern and it could be exploited for a profit. I’ll leave that to you.

While it does not happen often, the biggest concern is the integrity of the company holding your funds. It deserves careful research.

If you are going to trade cryptos, be sure to adjust for volatility. Volatility is risk. And because of the erratic price moves, using a mean-reversion strategy is likely to be better than trying to capture the trend. Most of all, start small.

A Standing Note on Short Sales

Note that the “All Signals” reports show short sales in stocks and ETFs, even though short positions are not executed in the equity portfolios. Our work over the years shows that downturns in the stock market are most often short-lived and it is difficult to capture with a longer-term trend. The upwards bias also works against shorter-term systems unless using futures, which allows leverage. Our decision has been to take only long positions in equities and control the risk by exiting many of the portfolios when there is extreme volatility and/or an indication of a severe downturn.

PORTFOLIO METHODOLOGY IN BRIEF

Both equity and futures programs use the same basic portfolio technology. They all exploit the persistence of performance, that is, they seek those markets with good long-term and short-term returns on the specific system, rank them, then choose the best, subject to liquidity, an existing current signal, with limitations on how many can be chosen from each sector. If there are not enough stocks or futures markets that satisfy all the conditions, then the portfolio holds fewer assets. In general, these portfolios are high beta, showing higher returns and higher risk, but have had a history of consistently outperforming the broad market index in all traditional measures.

PERFORMANCE BY GROUP

NOTE that the charts show below represent performance “tracking,” that is, the oldest results since are simulated but the returns from 2013 are the systematic daily performance added day by day. Any changes to the strategies do not affect the past performance, unless noted. The system assumes 100% investment and stocks are executed on the open, futures on the close of the trading day following the signals. From time to time we make logic changes to the strategies and show how the new model performs.

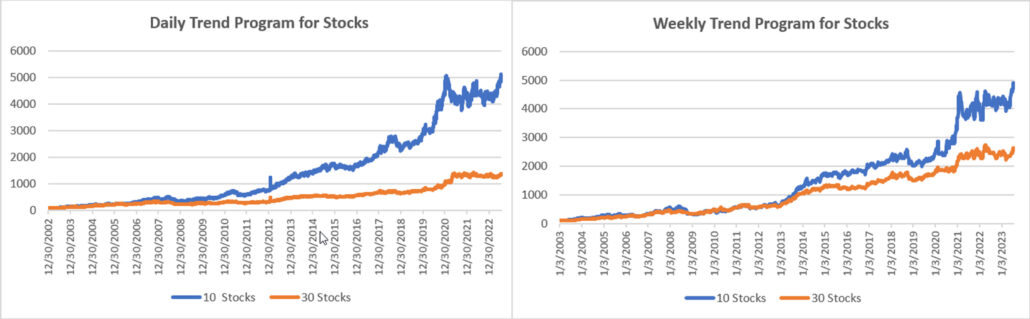

Groups DE1 and WE1: Daily and Weekly Trend Program for Stocks, including Income Focus, and DowHedge, and the new Sector Rotation

The Trend program seeks long-term directional changes in markets and the portfolios choose stocks that have realized profitable performance over many years combined with good short-term returns. It will hold fewer stocks when they do not meet our condition and exit the entire portfolio when there is extreme risk or a significant downturn.

July results show a clear move to new high equity after a long period of fighting the Fed. The 10-stock Daily program gained 3.2% to bring the 2023 returns to 17.5%. Not quite as good as the S&P, but with better risk controls. The Weekly program is tracking much the same, with new highs.

Income Focus and Sector Rotation

Returns for the July Income Focus program were essentially flat. The Daily program remains fractionally higher for the year while the Weekly program shows a 4% loss. This program has held up well against the Fed interest rate increases. We expect it to start gaining traction as soon as it is clear that rate hikes are over.

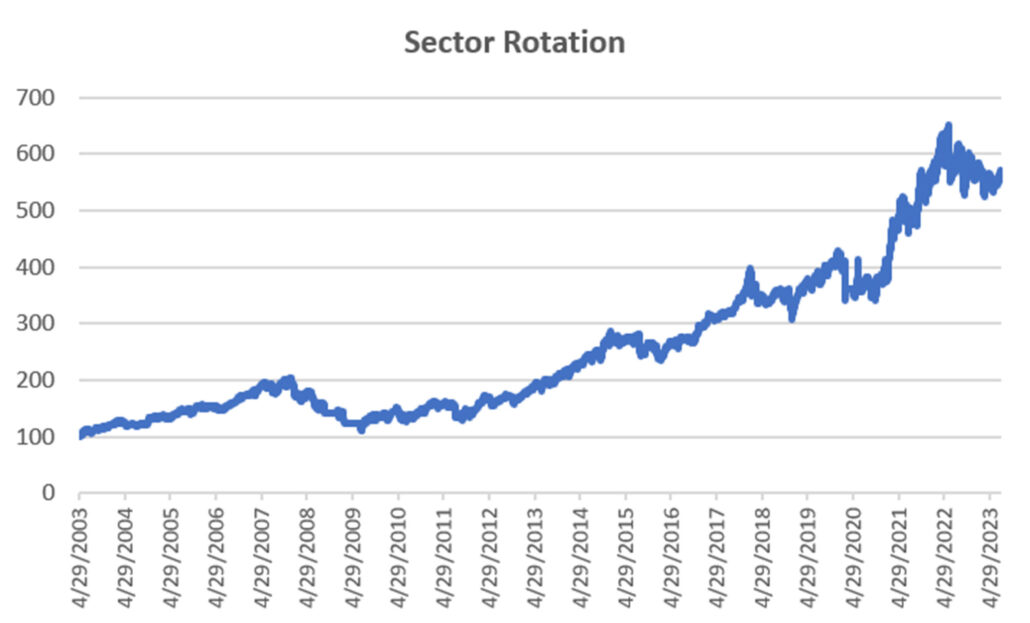

NEW Sector Rotation

A small gain in the Sector Rotation program puts year-to-date on the positive side. This program has opted for the conservative ETFs, which have shown much better returns than the more volatile tech and energy sectors. It will be interesting to see when they switch.

DowHedge Programs

The Daily DowHedge program just caught up to the Weekly program, gaining 4.5% in July. Now both programs are higher by about 7.5% for the year. While not making new highs, the chart looks positive, another indication that the economy is likely to recover.

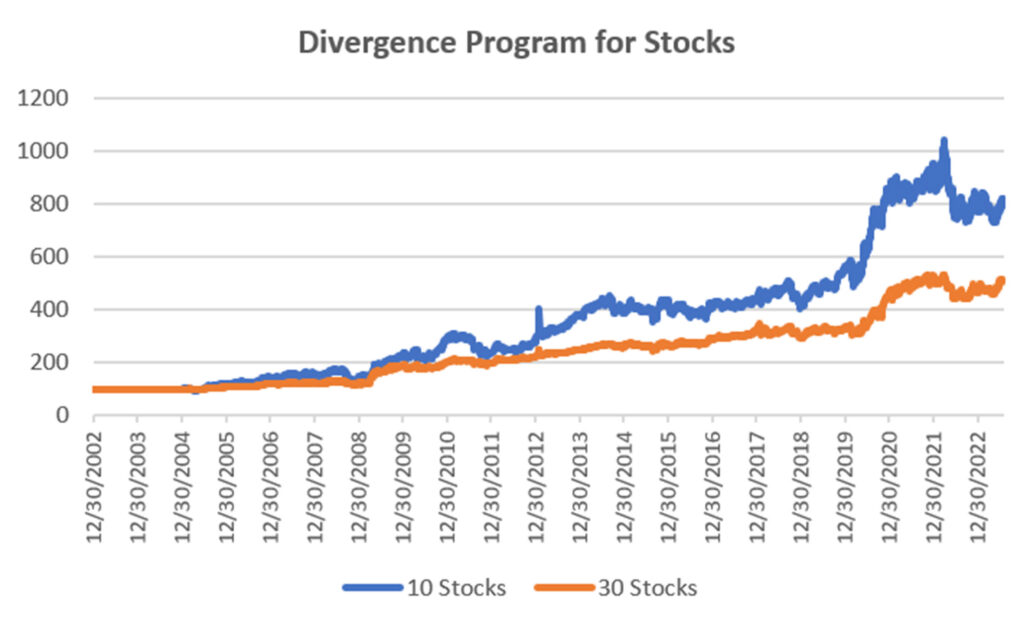

Group DE2: Divergence Program for Stocks

The Divergence program looks for patterns where price and momentum diverge, then takes a position in anticipation of the pattern resolving itself in a predictable direction, often the way prices had moved before the period of uncertainty.

Gains of 3.5% to 4.5% adds to the recovery for the Equity Divergence program. This strategy looks for pauses in an uptrend, a situation that has been rare for the past two years. As we see a recovery in the economy, we expect this program to catch up.

Group DE3: Timing Program for Stocks

The Timing program is a relative-value arbitrage, taking advantage of undervalued stocks relative to its index. It first finds the index that correlates best with a stock, then waits for an oversold indicator within an upwards trend. It exits when the stock price normalizes relative to the index, or the trend turns down. These portfolios are long-only because the upwards bias in stocks and that they are most often used in retirement accounts.

We need to go back through that past two months (actually all of 2023) to be sure we had recorded the daily returns correctly. When we switched to the new model, we kept recording the results of the old model. As it turns out, the new model has performed better, as we hoped.

July showed gains of about 5% in both the 10 and 20-stock portfolios, bringing the year-to-date results to 11.4% and 8.3% respectively. But the chart shows a very optimistic picture. This program buys pullbacks in an uptrend, a generally safe approach to trading. So far, so good.

Futures Programs

Groups DF1 and WF1: Daily and Weekly Trend Programs for Futures

Futures allow both high leverage and true diversification. The larger portfolios, such as $1million, are diversified into both commodities and world index and interest rate markets, in addition to foreign exchange. Its performance is not expected to track the U.S. stock market and is a hedge in every sense because it is uncorrelated. As the portfolio becomes more diversified its returns are more stable.

The leverage available in futures markets allows us to manage the risk in the portfolio, something not possible to the same degree with stocks. This portfolio targets 14% volatility. Investors interested in lower leverage can simply scale down all positions equally in proportion to their volatility preference. Note that these portfolios do not trade Asian futures, which we believe are more difficult for U.S. investors to execute. The “US 250K” portfolio trades only U.S. futures.

A volatile year for futures traders, most gains depending on interest rates which have been far from predictable. Our returns for July were mixed but the 2023 returns vary from +3% to +17%, showing that a small change in the portfolio can make a big difference in the results. We still expectd that major trends will develop in rates and currencies as soon as it is clear that the Fed has stopped hiking.

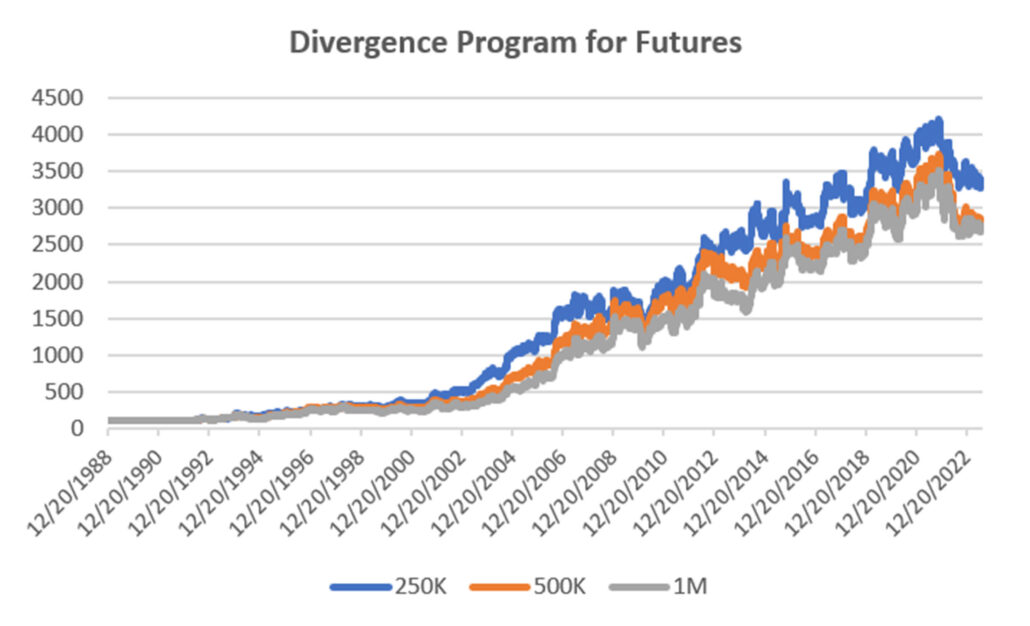

Group DF2: Divergence Portfolio for Futures

Gains in the Futures Divergence program of 2.25% to 3.0% is an encouraging sign. All portfolios are marginally ahead for the year, inline with the industry. This program looks for a pause in a trend, a situation that has been rare with no clear trends. We like to think that is a temporary situation, one that will change with Fed policy.

Blogs and Recent Publications

Perry’s books are all available on Amazon or through our website, www.kaufmansignals.com.

July 2023

Two(!) new articles by Perry in the August issue of Technical Analysis of Stocks & Commodities. The first is a look at how ChatGPT might help traders. It even asks for a computer program to use trend following.

The second article is “Portfolio Risk Dilemma,” where Perry answers the question of whether to let a stock or futures profit run or rebalance, and whether you should do the same for a diversified portfolio.

June 2023

Another article in Technical Analysis, “Protecting Your Wealth While Making a Profit.” It shows that moving money into different world equity markets can take advantage of momentum in both price and exchange rates.

May 2023

A new post on Seeking Alpha, “Profiting From Green Energy – But Not EVs” on May 31. Shows which stocks are best for investing in energy given the moving targets.

April 2023

On April 18th, Perry gave a webinar to the Society of Technical Analysts (London) on how to develop and test a successful trading system. Check their website for more details, https://www.technicalanalysts.com..

The April issue of Technical Analysis of Stocks & Commodities published a new article by Perry, “Repatriation,” an interesting trading pattern used by FX traders but adapted for us “normal traders.”

March 2023

Perry was interviewed by Mark Ursell of Ursell of TradeInform on March 3. You can see it or listen to it on UTube https://www.youtube.com/watch?v=9gIlIIzngCk. Or, you can listen to it at

A new article by Perry, “Can Volume Predict Price?” in the March issue of Technical Analysis of Stocks & Commodities. You’ll need to read it to find out!

February 2023

The February 2023 issue of Technical Analysis of Stocks & Commodities published Perry’s article, “Do Small Price Changes Matter?” It tells you whether you should be ignoring those days when prices close up or down by a fraction.

Perry gave a webinar to Eduardo Lopez’ Robotrader students in Spain on Wednesday, February 8, noon (New York).

January 2023

Another year! Technical Analysis of Stocks & Commodities published “Matching the Markets to the Strategy” in the January issue. It is a look at why certain markets do best with specific strategies and why that can materially improve results.

Alejandro de Luis will publish Perry’s article “Living Off Profits,” translated into Spanish, in the January issue of his magazine, Hispatrading. It’s a good way to practice your Spanish!

Seeking Alpha posted Perry’s article, “How To Hedge Your Equity Portfolio,” showing a way to follow the Fed action.

October 2022

An interview with Perry was featured in the October anniversary issue of Technical Analysis of Stocks & Commodities. The interviewer is his wife, Barbara Diamond, giving a different perspective on his career.

September 2022

“The Real Risk of System Trading” can be found in the September issue of Technical Analysis of Stocks & Commodities. It summarizes the many way we can measure risk and suggests ways that will help you.

Older Items of Interest

Perry’s webinar on risk, given to the U.K. Society of Technical Analysts, can be seen using the following link: https://vimeo.com/708691362/04c8fb70ea

For older articles please scan the websites for Technical Analysis of Stocks & Commodities, Modern Trader, Seeking Alpha, ProActive Advisor Magazine, and Forbes. You will also find recorded presentations given by Mr. Kaufman at BetterSystemTrader.com, TalkingTrading.com, FXCM.com, systemtrade.pl, the website for Alex Gerchik, Michael Covel’s website, TrendFollowing.com, and Talking Trading.com.

In May 2021, Mr. Kaufman gave a 30-minute presentation, “Lagged Trends,” for The Money Show on Tuesday, May 11. You can see it using the following link: https://youtu.be/bh2fA8oBwBk

You will also find back copies of our “Close-Up” reports on our website, www.kaufmansignals.com. You can address any questions to perry@kaufmansignalsdaily.com.

© July 2023, Etna Publishing, LLC. All Rights Reserved.