Industry Benchmark Performance

As of May 2, the industry reported small losses in stocks and small gains in futures. Overall, futures seem to have the edge this year. But year-to-date returns are still positive, a good sign for investors. The Fed said that it would not raise rates, but cutting rates is all about inflation.

Kaufman’sMost Popular Books (available on Amazon)

Trading Systems and Methods, 6th Edition. The complete guide to trading systems, with more than 250 programs and spreadsheets. The most important book for a system developer.

Kaufman Constructs Trading Systems. A step-by-step manual on how to develop, test, and trade an algorithmic system.

Learn To Trade. Written for both serious beginners and practiced traders, this book includes chart formations, trends, indicators, trading rules, risk, and portfolio management. You can find it in color on Amazon.

You can also find these books on our website, www.kaufmansignals.com.

Blogs and Recent Publications

Find Mr. Kaufman’s other recent publications and seminars at the end of this report. We post new interviews, seminars, and reference new articles by Mr. Kaufman each month.

April Performance in Brief

Disappointment was the theme for April. It was interesting that one of the Fed governors said a month ago that lower rates might not come this year. Was that orchestrated by the Fed or just a personal comment? Hard to believe that the Fed would make any kind of personal comment.

We now have a dilemma. Rates for longer while employment is high. Some stocks are thriving and others are failing. The market drops on any Fed news, then recovers. Not an easy pattern for traders. So far, we are holding onto gain, which we think is as good as it gets.

Major Equity ETFs

The major equity ETFs fell more than 4% and the small caps nearly 7%, in what looks like a capitulation of the market. However, there are still profits for the year and the equity markets have been resilient. Even while interest rates are high, consumers are buying. Just not at McDonald’s. This looks like a boon for discount stores and groceries.

CLOSE-UP: How to Use On-Balance Volume and Market Breadth

There are certain stock-market indicators that I like, among them are On-Balanced Volume (OBV) and Market Breadth (the number of stocks gaining or losing). I’ve tried some variations of OBV only to find that the original rules were best. I like market breadth because it implies equal weight, which I believe does better telling the underlying trend of the stock market, even though prices may be moved by a few very-high cap stocks.

I’ll apply these indicators only to SPY from 1998, which is the most likely target.

The Rules for On-Balanced Volume

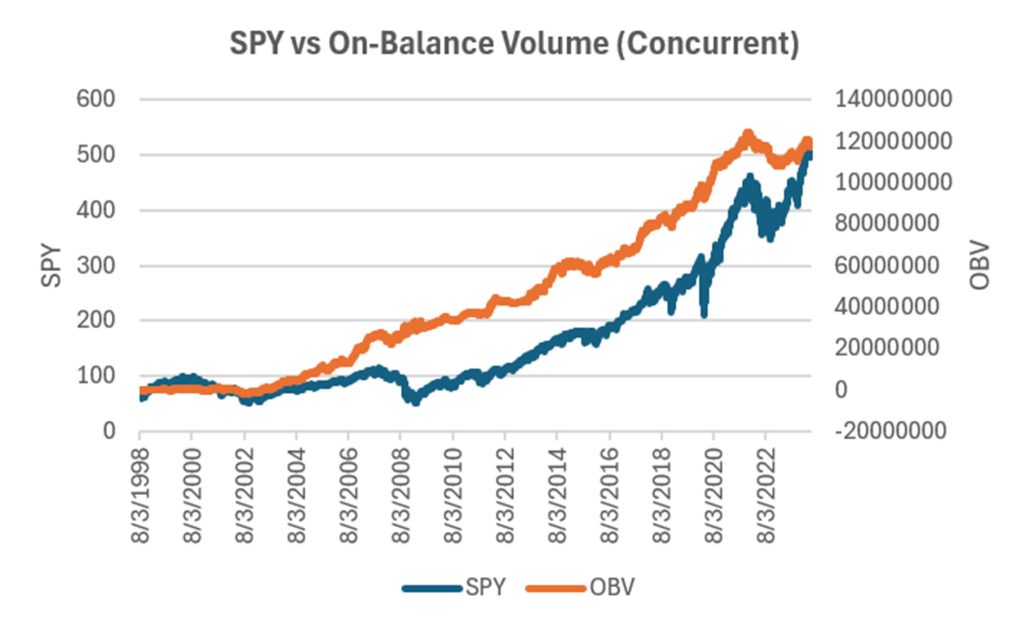

The original Granville rules are very simple. It creates an OBV index. If the SPY prices are higher, then add all volume to OBV. If prices are lower, then subtract all volume from OBV. A chart of SPY and OBV are shown in Figure 1. OBV looks good, smoother and slightly ahead of SPY. Values can be quite large, as seen on the right scale.

Figure 1. SPY compared to OBV from 1998.

The Rules for Breadth

It turns out that there are a lot of indicators for market breadth. But first, how can you access the data? I use Commodity Systems Inc (CSI) which has it in two different series:

- UVDV: Date, Total Traded, Adv, Dec, Unch, Up Volume, Down Volume

- MKST: Date, Total Traded, Adv, Dec, Unch, 52-week highs, 52-week lows

The interpretation of breadth is much the same as volume:

- Breadth Price Interpretation

- Rising Rising Breadth confirms price rise

- Falling Falling Breadth confirms price drop

- Falling Rising Breadth does not confirm price rise

- Rising Falling Breadth does not confirm price drop

Here are some of the well-known indicators. You can find more detail on-line or in my “Trading Systems and Methods” book. This is a short summary.

- Separating Advancing from Declining Volume

- Advance-Decline Oscillator = Advances – Declines

- Sibbett’s Demand Index

- Sum of upside volume/ Sum of downside volume

- McClellan Oscillator

- Smoothing the advances and declines with a 19- and 39-day exponential

- Bolton-Tremblay

- (Advancing – Declining) / Unchanged (Could jump around)

- Schultz

- Advancing / Total Stocks

- Upside/Downside Ratio

- Advancing volume / Declining volume

- Arms Index (TRIN)

- (Advancing stocks / Declining stocks) / (Adv volume / Declining vol)

- Thrust Oscillator

- 100 x (Adv stocks x vol of adv stocks – Decl stocks x vol of decl stocks) /

- (Adv stocks x vol of adv stocks + Decl stocks x vol of decl stocks)

- 100 x (Adv stocks x vol of adv stocks – Decl stocks x vol of decl stocks) /

- New Highs and Lows (an index)

- HLindex(t) = HLindex(t-1) + NH(t) – NL(t) Similar to Granville

Is one indicator better than another?

Personally, I can’t think of any more combinations. If I were going to pick one, I would look for the advancing stocks (or declining stocks) divided by the total stocks, much like Schulz. I can see problems with most of the others, and I favor simplicity.

Using the On-Balance Approach

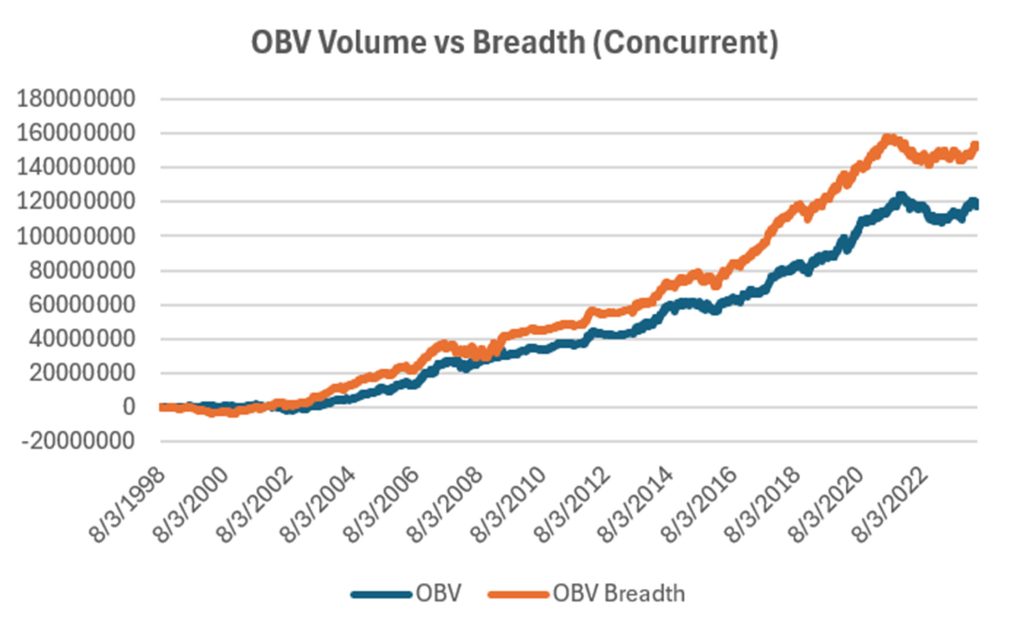

Because Granville’s OBV produced a smooth curve, I thought that I would apply the same technique to breadth. The rules would be:

If the advancing stocks are greater than the declining stocks, add the total volume to the Breadth Indicator. If advances are less than declines, subtract the total volume from the indicator. We get the results for SPY in Figure 2.

Figure 2. Comparing our Breadth Indicator with OBV using SPY volume.

Notice that in Figures 1 and 2 I’ve put the work “concurrent.” It means that we are adding the current volume based on today’s price movement or today’s breath. That may be unrealistic. Most traders will download data after the close, do their analysis, and execute the next day. Still, using the same rules, the Breadth Indicator is slightly better than OBV.

How Can We Use Them?

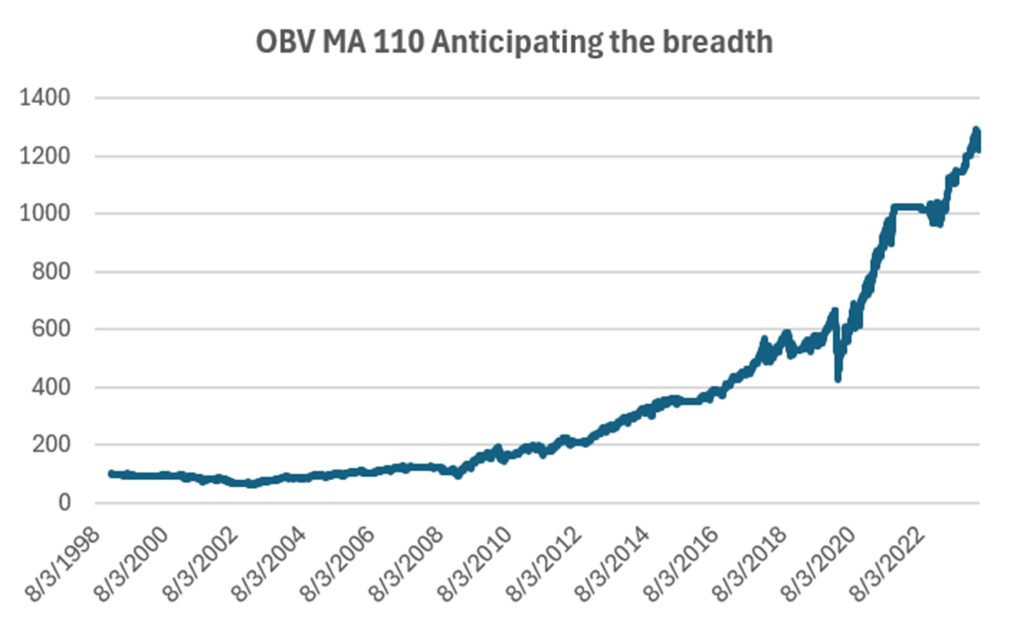

From experience, I know that the best moving average for SPY is 110 days. Of course that depends on when you start, but we’ll use 1998. The other rule is that we enter on the next day. Normally, we’ll use the opening price as our entry, but for this test we’ll use the closing price of the next day. Given the smoothness of the curves, it should still work.

SPY 110-Day Moving Average Results

If we use a 110-day moving average on SPY, entering on the next day, we get the following NAVs in Figure 3. For comparison, I’ve put the 30-day moving average results.

Figure 3. SPY results using a 110-day moving average and a 30-day moving average.

OBV and Breadth Indicator Entering the Next Day

Entering the next day on the close may not be as good as the open, but it should not be far off if the series is smooth. Figure 4 and Figure 5 show the NAVs for OBV and Breadth given entering on the next close. Besides, lagging 1 day is a way to see robustness.

Figure 4. Results of using OBV on SPY, entering on the next close.

Figure 5 is similar to Figure 4. It shows using the Breadth Indicator lagging 1 day.

Figure 5. Results of using the Breadth Indicator, entering on the next close.

The results in Figures 4 and 5 are disappointing. They may be profitable, but far from what we had expected looking at the smooth curves of the indicator values in Figure 2. How can we duplicate those results?

Anticipating Price and Volume

Years ago, we had to wait for the next day to get volume data. Now it can be seen throughout the day. It can be downloaded (unless you’re a computer expert), but you can see the values at any time.

For OBV, we can usually tell if the closing price is going to be higher or lower. We can also find the total volume at that time. We can then apply a moving average to the new OBV value and execute on the concurrent close.

For the Breadth Indicator we need to know only if the number of advancing stocks is greater than the declining in order to add or subtract the volume. If you want to try it, the returns for OBV are in Figure 6 and the Breadth Indicator in Figure 7.

Figure 6. Anticipating todays OBV value using a 110-day moving average applied to SPY.

Figure 7. Anticipating today’s Breadth Indicator using a 110-day moving average applied to SPY.

Summary

I would normally show the returns and risk of each method, but I think the charts are clear. Both the OBV and Breadth Indicators are far better than the moving averages applied to SPY, but they require some work.

I have done trading where I needed to know, as of the close, whether prices were going to be higher or lower. Generally, it is easy. On some days, the price change is near zero and you need to guess. If that guess is wrong, you reverse your trade as soon as possible. It doesn’t happen often.

This study shows how important it can be to anticipate. One day can make a lot of difference.

A Standing Note on Short Sales

Note that the “All Signals” reports show short sales in stocks and ETFs, even though short positions are not executed in the equity portfolios. Our work over the years shows that downturns in the stock market are most often short-lived and it is difficult to capture with a longer-term trend. The upwards bias also works against shorter-term systems unless using futures, which allows leverage. Our decision has been to take only long positions in equities and control the risk by exiting many of the portfolios when there is extreme volatility and/or an indication of a severe downturn.

PORTFOLIO METHODOLOGY IN BRIEF

Both equity and futures programs use the same basic portfolio technology. They all exploit the persistence of performance, that is, they seek those markets with good long-term and short-term returns on the specific system, rank them, then choose the best, subject to liquidity, an existing current signal, with limitations on how many can be chosen from each sector. If there are not enough stocks or futures markets that satisfy all the conditions, then the portfolio holds fewer assets. In general, these portfolios are high beta, showing higher returns and higher risk, but have had a history of consistently outperforming the broad market index in all traditional measures.

PERFORMANCE BY GROUP

NOTE that the charts show below represent performance “tracking,” that is, the oldest results since are simulated but the returns from 2013 are the systematic daily performance added day by day. Any changes to the strategies do not affect the past performance, unless noted. The system assumes 100% investment and stocks are executed on the open, futures on the close of the trading day following the signals. From time to time we make logic changes to the strategies and show how the new model performs.

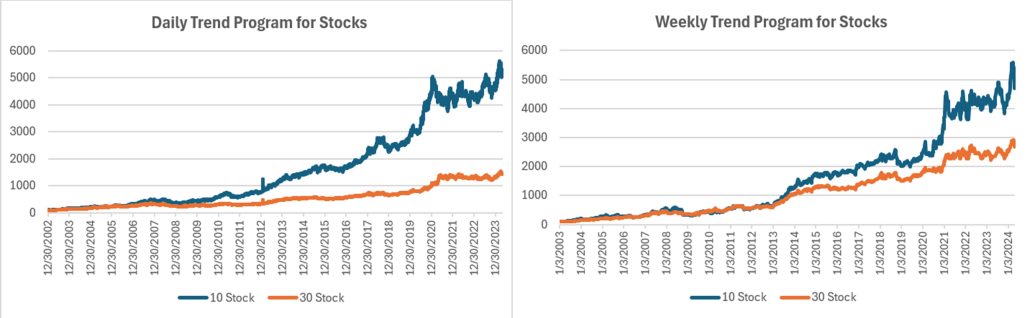

Groups DE1 and WE1: Daily and Weekly Trend Program for Stocks, including Income Focus, DowHedge, Sector Rotation, and the New High-Risk Portfolio

The Trend program seeks long-term directional changes in markets and the portfolios choose stocks that have realized profitable performance over many years combined with good short-term returns. It will hold fewer stocks when they do not meet our condition and exit the entire portfolio when there is extreme risk or a significant downturn.

This month’s reversal offsets some of the gains for 2024, but we’re still optimistic. If the economy falters, the Fed will cut rates. If not, the economy will be strong and earning should be good.

The Daily Trend program lost over 7% and 8% but still is well ahead for the year. The Weekly program (as of last Friday) lost 11% and 5.7% and is also ahead by the same amount as the Daily program. May should be interesting!

Income Focus and Sector Rotation

A reversal in the Income Focus program as rates flop between bullish and bearish sentiment. The programs lost 1% and 2%, leaving them mostly flat for the year. Predicting returns is going to be difficult for the next few months.

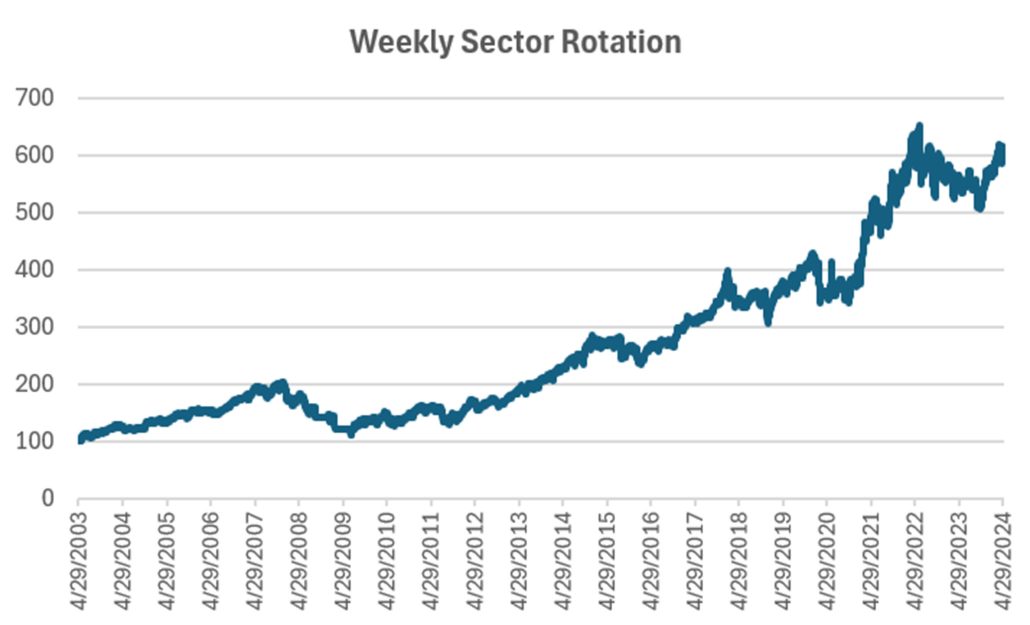

Sector Rotation

This program seems to be holding the same positions for months at a time, but returns are very similar to the rest of the market. April lost less than 2% and year-to-date is still higher by 7%.

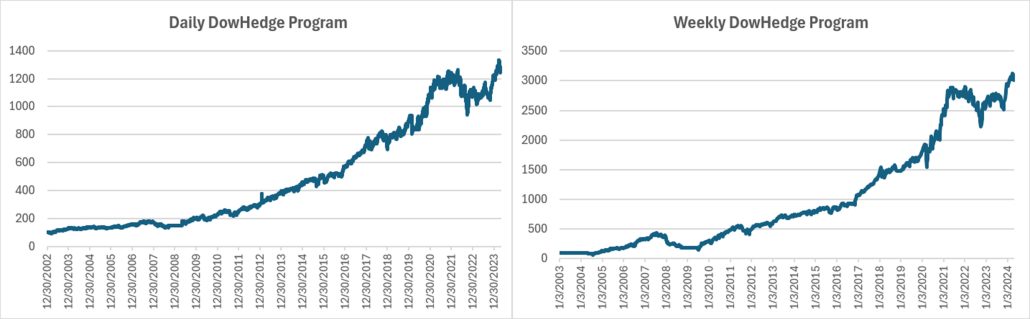

DowHedge Programs

Much the same results in both the DowHedge programs as in the Trend programs. April posted losses of 5.6% and 3.25% and both are ahead for the year by 2.4%. The charts still look positive.

The New High-Risk Portfolios

Perhaps this wasn’t the best time to start a program focusing on tech and healthcare, but the losses in April are typical of the profile we expect. Some internet and AI stocks, plus Lilly have done well. We still like this program, even though it lost a bit more than the diversified trend program in April.

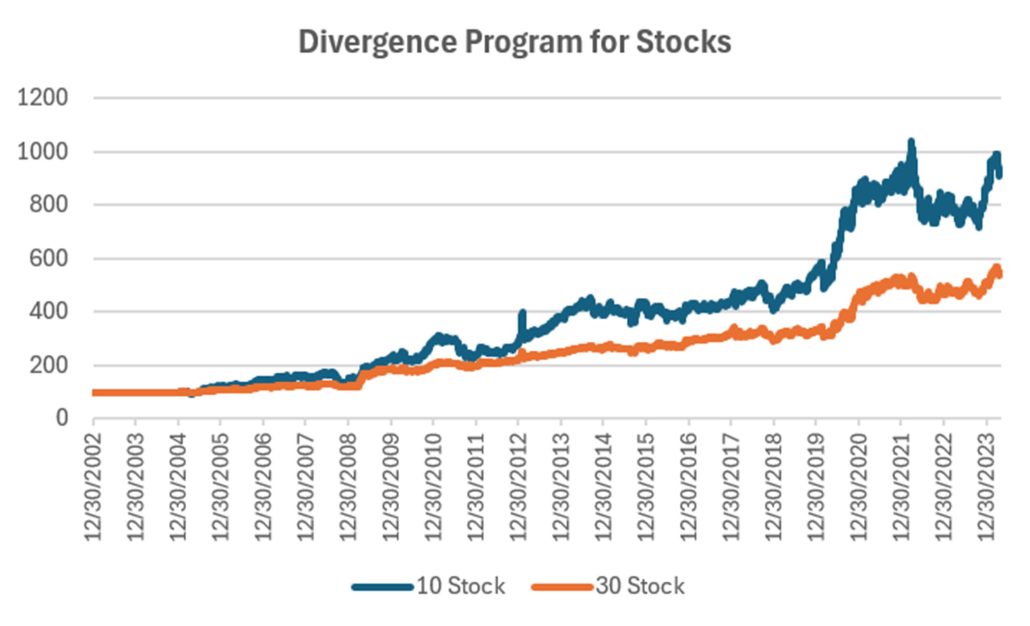

Group DE2: Divergence Program for Stocks

The Divergence program looks for patterns where price and momentum diverge, then takes a position in anticipation of the pattern resolving itself in a predictable direction, often the way prices had moved before the period of uncertainty.

A similar loss in the Divergence program. It seems that when the market turns, nothing is safe! April losses of 5% to nearly 7% still leaves both portfolios ahead by about 6.5% for the year.

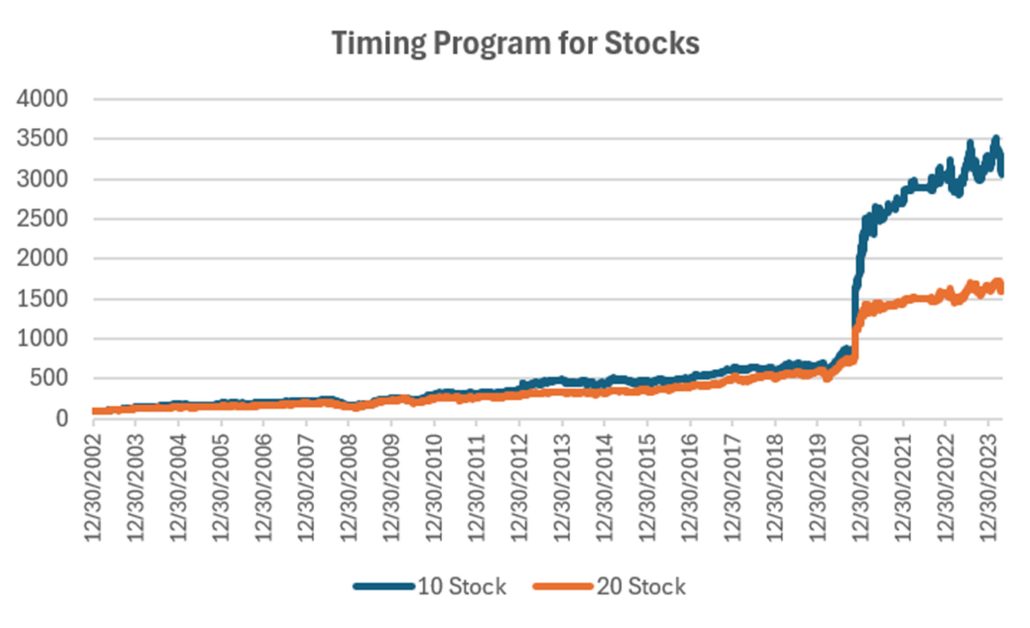

Group DE3: Timing Program for Stocks

The Timing program is a relative-value arbitrage, taking advantage of undervalued stocks relative to its index. It first finds the index that correlates best with a stock, then waits for an oversold indicator within an upwards trend. It exits when the stock price normalizes relative to the index, or the trend turns down. These portfolios are long-only because the upwards bias in stocks and that they are most often used in retirement accounts.

Timing turned negative for the year after a loss of about 5%. It’s a frustrating year for this program, which needs a trend and a pullback. While there have been modest trends, the pullbacks have all turned into trend reversals. At some point the Fed will announce its interest rate reduction and we should see some gains.

Futures Programs

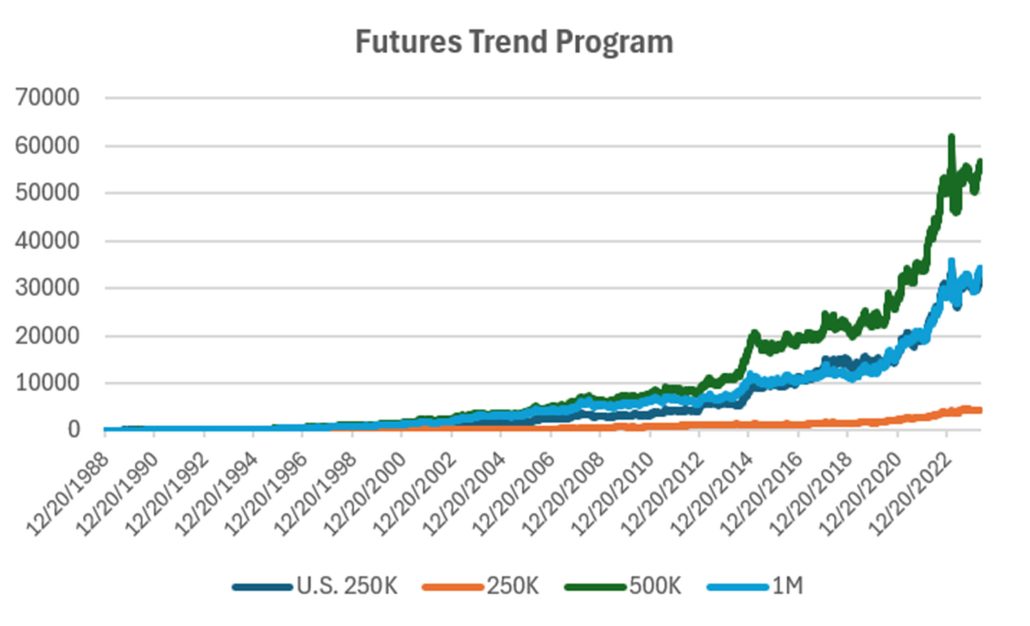

Groups DF1 and WF1: Daily and Weekly Trend Programs for Futures

Futures allow both high leverage and true diversification. The larger portfolios, such as $1million, are diversified into both commodities and world index and interest rate markets, in addition to foreign exchange. Its performance is not expected to track the U.S. stock market and is a hedge in every sense because it is uncorrelated. As the portfolio becomes more diversified its returns are more stable.

The leverage available in futures markets allows us to manage the risk in the portfolio, something not possible to the same degree with stocks. This portfolio targets 14% volatility. Investors interested in lower leverage can simply scale down all positions equally in proportion to their volatility preference. Note that these portfolios do not trade Asian futures, which we believe are more difficult for U.S. investors to execute. The “US 250K” portfolio trades only U.S. futures.

Some analyst would argue that Futures gain when stocks fall. But that’s not always the case. It would be a case of being able to short on high leverage, but there are no real trends to speak of. Nevertheless, Futures performance was mostly better in April, except for the $250K account, and year=to-date performance is similar to the industry, up by 7% to 11% with only the $250K account negative. The account size makes a difference in what a portfolio can hold, and its ability to diversify.

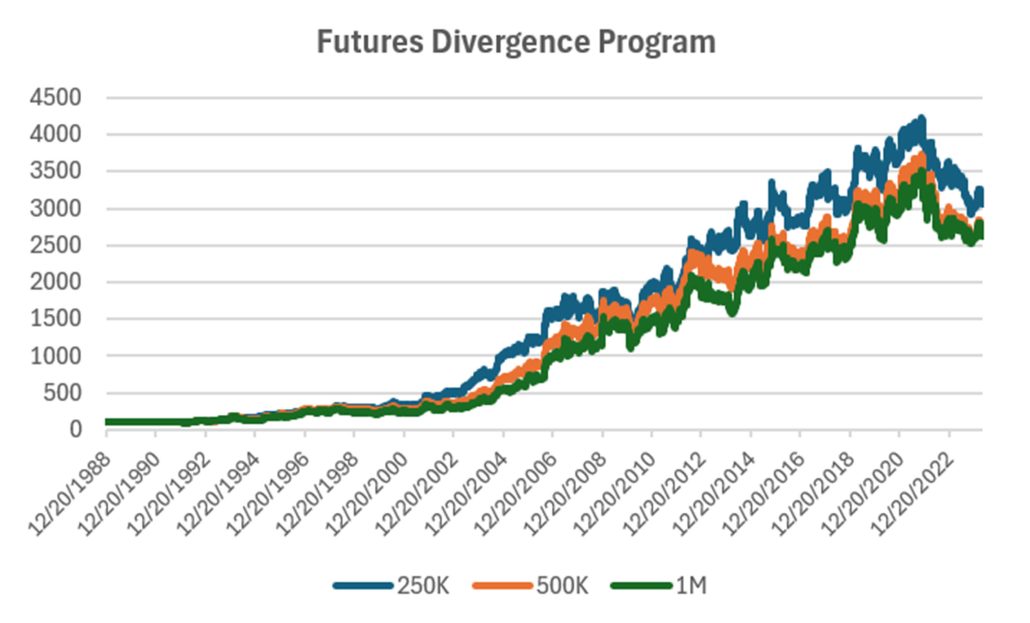

Group DF2: Divergence Portfolio for Futures

Losses of 4% to 5% is much in line with the Equity Divergence program. Not much trend and pullbacks tend to reverse that trend. Still, the program is slightly ahead for the year and the chart shows a stabilizing pattern.

Insert Futures Divergence charts

Blogs and Recent Publications

Perry’s books are all available on Amazon or through our website, www.kaufmansignals.com.

May 2024

In the April edition of Technical Analysis, Perry again deals with risk in “How Professional Assign Risk.” It is another chapter in how to protect yourself.

April 2024

Another article in the April edition of Technical Analysis, “Determining Risk Before It Happens.” Perry thinks this is an article everyone should read.

March 2024

In the 2024 Bonus Issue of Technical Analysis, Perry has an article, “Pros and Cons of Daily Versus Weekly Trend Following.” There is also a quote by him in the “Retrospective: Interviews” going back to April 1988.

Perry also posted an article on Seeking Alpha, “How To Exit a Trade.” A good reminder of the choices.

February 2024

Perry published an article on using the backwardation and contango in crude oil in “The Delta-Delta Strategy.” If not crude, the you might think of this for any commodity, including interest rates, that have a consistent term structure.

January 2024

A new article in February edition of Technical Analysis of Stocks & Commodities, “Crossover Trading: Arbitrating the Physical with the Stock.” A chance at diversification!

Perry posted 3 new articles on Seeking Alpha in December, “Where Do You Take Profits?”, “Is There a Better Day to Enter the Market,” and “Watching January Returns.”

Another article in Technical Analysis of Stocks & Commodities, “Gap Momentum,” another interesting way to identify the trend.

December 2023

Perry posted 3 new articles on Seeking Alpha, “Where Do You Take Profits?”, “Is There a Better Day to Enter the Market,” and “Watching January Returns.”

This month Technical Analysis of Stocks & Commodities published “A Strategy For Trading Seasonal and Non-Seasonal Market.” Turns out that most markets are non-seasonal!

November 2023

Perry posted two articles on Seeking Alpha, “Compression Breakout: Giving a Boost to Your Entries,” and “Volatility: The Second Most Important Indicator.” In addition, he interview Herb Friedman in Technical Analysis of Stocks & Commodities. Herb is a interest rate specialist focusing on low risk investments.

October 2023

In this month’s Technical Analysis of Stocks & Commodities Perry shows how Merger Arb works and how an investor can participate in it. Merger Arb has been the realm of Institutions, but there are opportunities for everyone.

August 2023

Two(!) new articles by Perry in the August issue of Technical Analysis of Stocks & Commodities. The first is a look at how ChatGPT might help traders. It even asks for a computer program to use trend following.

The second article is “Portfolio Risk Dilemma,” where Perry answers the question of whether to let a stock or futures profit run or rebalance, and whether you should do the same for a diversified portfolio.

June 2023

Another article in Technical Analysis, “Protecting Your Wealth While Making a Profit.” It shows that moving money into different world equity markets can take advantage of momentum in both price and exchange rates.

Older Items of Interest

On April 18th, 2023 Perry gave a webinar to the Society of Technical Analysts (London) on how to develop and test a successful trading system. Check their website for more details, https://www.technicalanalysts.com..

Perry’s webinar on risk, given to the U.K. Society of Technical Analysts, can be seen using the following link: https://vimeo.com/708691362/04c8fb70ea

For older articles please scan the websites for Technical Analysis of Stocks & Commodities, Modern Trader, Seeking Alpha, ProActive Advisor Magazine, and Forbes. You will also find recorded presentations given by Mr. Kaufman at BetterSystemTrader.com, TalkingTrading.com, FXCM.com, systemtrade.pl, the website for Alex Gerchik, Michael Covel’s website, TrendFollowing.com, and Talking Trading.com.

You will also find up to six months of back copies of our “Close-Up” reports on our website, www.kaufmansignals.com. You can address any questions to perry@kaufmansignalsdaily.com.

© April 2024, Etna Publishing, LLC. All Rights Reserved.