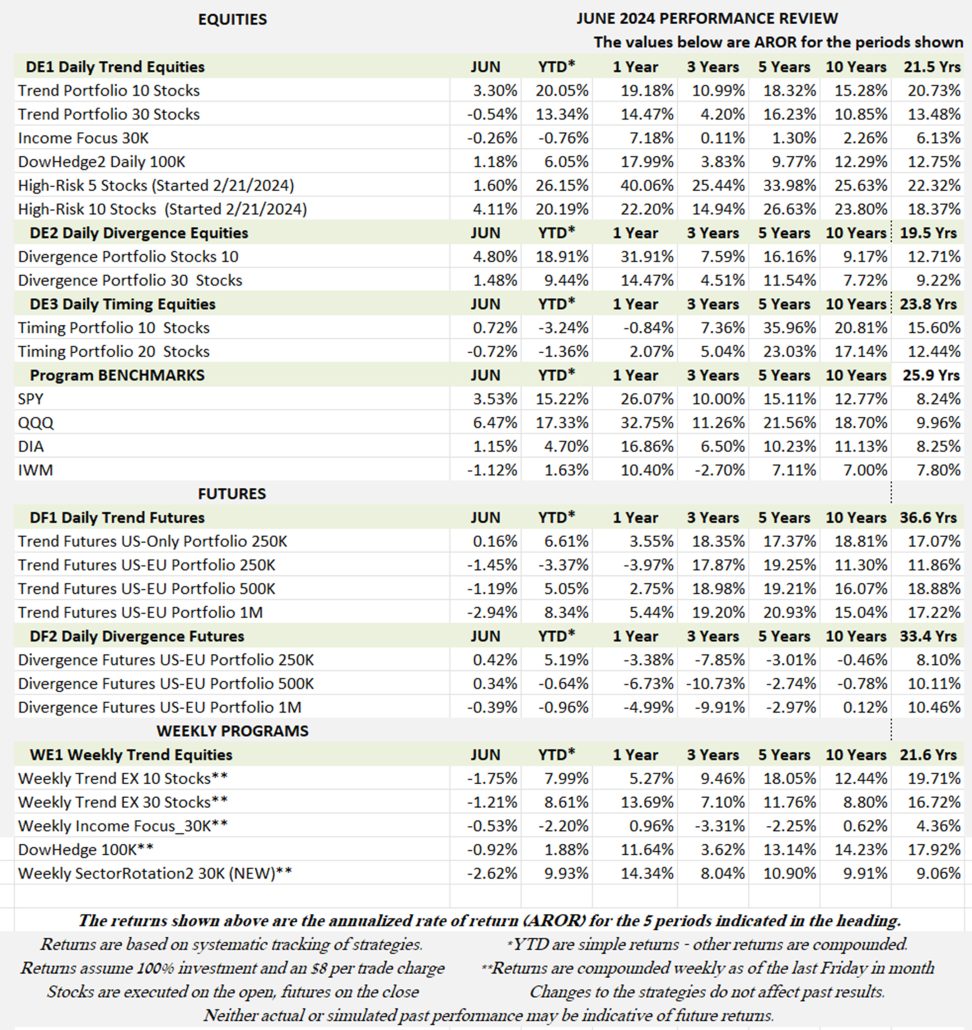

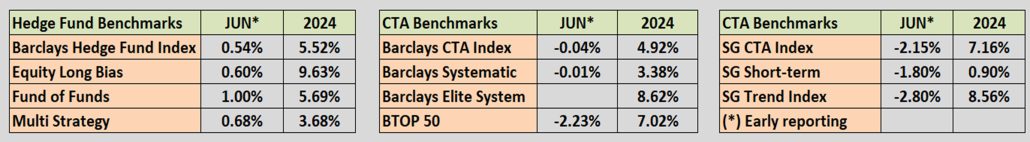

Industry Benchmark Performance

As of July 1, the equity funds posted fractional better returns, while the CTAs were fractionally lower. It is unlikely that we will see anything significant until the Fed makes cuts in interest rates clear.

Source: BarclayHedge Indices.

Kaufman’sMost Popular Books (available on Amazon)

Trading Systems and Methods, 6th Edition. The complete guide to trading systems, with more than 250 programs and spreadsheets. The most important book for a system developer.

Kaufman Constructs Trading Systems. A step-by-step manual on how to develop, test, and trade an algorithmic system.

Learn To Trade. Written for both serious beginners and practiced traders, this book includes chart formations, trends, indicators, trading rules, risk, and portfolio management. You can find it in color on Amazon.

You can also find these books on our website, www.kaufmansignals.com.

Blogs and Recent Publications

Find Mr. Kaufman’s other recent publications and seminars at the end of this report. We post new interviews, seminars, and reference new articles by Mr. Kaufman each month.

June Performance in Brief

Another tenuous month for trends, with traders buying stocks whenever there was no news, and selling when a new economic report showed less than expected reduction in inflation. Still, there is a slow tendency towards the 2% goal of the Fed.

Even with the uncertainty, our programs did well in June. The daily equity programs are all better than the S&P ETF, except that the Weekly program is lagging after doing well earlier this year. Futures seem to be going nowhere, but a surge in rates could easily change that.

Major Equity ETFs

Nasdaq (QQQ) continued to move higher, despite the forecasts that AI and semiconductors are at extreme risk of reversing. We have seen this before, with Apple, Tesla, and Amazon. No one really knows how long a rally will last.Major Equity ETFs

The S&P (SPY) gained along with QQQ given that it is driven by the same stocks. The DOW (DIA) and the Russell (IWM) do not have those stocks. Performance is marginally profitable for the year.

CLOSE-UP: Summer Reading List for Traders

New and Old Summer Reading to Improve you trading

(NOTE: You don’t need to read these if you’re busy. You can just read my summary!)

Only one of these books deal with the market directly. They are mostly about how to make a better decision. If you’ve read books that offer a great system and found that you were disappointed, you will find these books enlightening. Even after reading these reviews, it is always better to read the book – your opinion may be different than mine!

Thinking, Fast and Slow by Daniel Kahneman.

I tried reading this when it first came out and got to about page 50 before falling asleep. Yet it has some important advice for traders. In this case, I’m using a review by John Reeves (the Motley Fool) with quite a few comments of my own.

Thinking fast refers to the part of our brain that responds to emergencies. When we need to act fast, our brain has an automated response. Thinking slow is about how we think out a logical problem, long-term planning.

Here are some of the main points, with my own comments:

- We tend to overestimate our investing abilities, especially about risk.

- Don’t react quickly to news but take time to evaluate the situation. Don’t fall for “buy now, before it’s too late!”

- There are no guarantees when you buy a stock, even when you think it’s a sure bet.

- We tend to be optimistic about our decisions, which can be unrealistic. On the other hand, if we weren’t optimistic, no one would ever start a new venture or buy a stock. The biggest problem is that optimists tend to expect profits sooner. I’ve started a number of new companies, expecting each to be profitable in one year. If I was lucky, it took five.

- Don’t concentrate on daily returns, they are too volatile and can be depressing.

- Have a strategy, test is carefully, and stick to it.

- Luck plays a greater role than we think. Personally, I think “luck comes to those who are best prepared.” It is a variation of the Roman philosopher Seneca who said, “luck is what happens when preparation meets opportunity.” However, don’t forget the “skill” part.

- Using past data is inevitable, but the value is in the big picture. There are long-term trends and short-term noise. More than that is questionable.

How does this help you trade?

Be realistic about risk. Look at the big picture. Learn as much as possible about different market situations Just like the golfer that spends time practicing from the concrete golf path or hitting from behind a tree. Their great shots are not luck – they are skill.

Thinking in Bets by Annie Duke

I just read this recently. It turns out to be a study in psychology. It all stems from the phrase “Do you wanna bet?”

When you make a statement that you believe is “fact,” and someone says, “Do you want to bet?” you are forced to reconsider what you have said. You now try to reevaluate in what situations you could be wrong. Very few “facts” are 100% certain.

The author distinguishes between a good decision and a bad outcome. If we have 75% confidence in a decision, that leaves a 25% chance that it can go wrong. A bad outcome does not change a good decision.

If I’m a trend following and only 1/3 of my trades are profitable, I need to remember that the profitable trades are far larger than the losses, and they will result in profits “in the long-term.” Don’t let the outcome come between you and a good strategy. Even a short-term strategy that has a 75% chance of a good trade can have four or more losses in a row. They were still good decisions with a poor outcome.

When you work with others on a strategy, they can find errors, or introduce improvements. In my career, I have worked alone about 50% of the time, and worked in groups for the other 50%. I have found that working in groups is much more satisfying, and the results are better. The group forces you to be accountable for your decision.

In a classic MBA course, they use an example at the 3M Corporation. At a general get-together of their research group, one member mentioned that he was trying find a better adhesive glue, but he only found one that wouldn’t hold. Another researcher said, “I have an idea,” and they created Post-Its, one of their most profitable products.

On the other hand, there is a cute story about Justice Thomas. It is said that he won’t hire anyone who disagrees with his philosophy. “It’s like trying to train a pig. It wastes your time and it aggravates the pig.” However, I was a partner in a farm that raised pigs. They are surprisingly smart.

With regard to news, we cannot assume that one version is correct. I believe that all news that I see and read is biased by omission. I don’t think it’s always intentional. It’s just the way the reporters think. I’ve been accused of being skeptical about the news. “Where did it come from?” “Who said it?” “Is there another source?” Do we believe a drug company when they say they have a cure for a disease? What are the side effects and what is the cost? How many people died during testing? I test my internet speed using an independent internet program. It shows about 500 megabits although I pay for 1,000. When I ask the provider why it is so low, they recommend using their own speed test. Hmmm. Which do I believe? On the other hand, does the “independent” program have an agenda as well?

How Does This Help Trading?

You can form a strategy by watching how the market reacts to news or noting that a lower open in stocks is likely to end higher than the open, because of the upwards bias.

Our reaction to outcomes are path-dependent. If you win first, then lose, you a negative. If you lose then win, you are positive.

The book is about trying to find the truth. Focus on the future and how to get there. Try to account for as many scenarios as possible. Perhaps the author should have read “The Psychology of Money” in planning for the future.

The Logic of Failure by Dietrich Dörner

This has been my favorite book for years. It doesn’t tell you the conclusion, you need to figure it out yourself. It’s a book about making complex decisions.

The study takes 12 top executives and puts them in complete charge of a small African country, Tanaland. The people are poor, and the object is to improve their quality of life. The software used will try to forecast what happens over the next 20 years, based on whatever the “president” decides.

For example, some chose to excavate for water and plant crops. Others could improve fertilization, introduce orchards, build dams, and invest in tractors. They could electrify. All good ideas.

Forecasting that forward, most of those decisions showed short-term benefits, but with unexpected consequences. Most decisions worked for a few years, until the water ran out and the people were worse than before. When things went well, population increased and the resources were not sufficient to handle that.

If I remember correctly, two of the twelve were successful. Why? How does this affect our trading?

Spoiler Alert!

My own conclusion is that the two successful players continued to reevaluate their decisions. They could modify their actions. The other players were convinced that their solution was correct and they waited for history to justify their actions. That didn’t happen. Long-term and complex decisions need constant, or at least periodic review, just like a trading system. Before 2008, we didn’t realize the extent of a drawdown. Now we have risk controls to avoid those losses. Read this yourself and decide why only a few were successful.

The Psychology of Money by Morgan Housel

This is an excellent book for a young person starting an investment, or a parent instilling good habits on a child. It’s about saving and compounding. To reach peak performance, we need to compound. As we gain profits, we increase our exposure. But first, we need to accumulate.

One big theme is the need to save money. Personally, I can relate to this. Whenever I talked to my mother, she always asked “Are you saving money?” As a young person, we thought we would make so much in the future that we did not need to worry about the present. It turns out that saving money means that you don’t need to earn a lot to accumulate large savings over time.

I’m reminded of an old book by Clason, “The Babylon Course in Financial Success.” It starts with saving 10% of your income. This idea has been around for a long time, but remains true.

In a review by bankrate.com (by Karen Bennett), it’s all about frugality and humility. Raising your humility is often a more powerful driver than raising your income. And, cash in the bank has unseen returns. However, those are not attributes that I would associate with a trader.

In her review, it recognizes that having a nest egg reduces stress, and in the worst case, if you are out of work, it can carry you through a tough time. It is the “unseen return on wealth.”

In Bennett’s review, she recounts Housel telling the story of Ronald Read, a gas station attendant and janitor who eventually went on to become an investor and philanthropist. Throughout his life, Read gradually accumulated a fortune by saving what he could and investing in blue chip stocks. When he died at 92, he made headlines for being worth more than $8 million dollars — much of which was accumulated through the power of compound interest.

Housel contrasts Read’s story with that of a highly educated, well-paid Lynch executive who retired in his 40s to become a philanthropist. Heavy spending on a lavish lifestyle that included two luxury homes eventually led him to file for bankruptcy.

Through the two men’s stories. Housel makes the point that financial success is often more a matter of how you behave than what you know.

How Does This Help Trading?

Having a safety net allows you to trade with less stress. Of course, you want to start slowly to understand the risk and rewards. Having good work habits, not overspending, having enough to field losses are important qualities for a successful trader.

A Standing Note on Short Sales

Note that the “All Signals” reports show short sales in stocks and ETFs, even though short positions are not executed in the equity portfolios. Our work over the years shows that downturns in the stock market are most often short-lived and it is difficult to capture with a longer-term trend. The upwards bias also works against shorter-term systems unless using futures, which allows leverage. Our decision has been to take only long positions in equities and control the risk by exiting many of the portfolios when there is extreme volatility and/or an indication of a severe downturn.

PORTFOLIO METHODOLOGY IN BRIEF

Both equity and futures programs use the same basic portfolio technology. They all exploit the persistence of performance, that is, they seek those markets with good long-term and short-term returns on the specific system, rank them, then choose the best, subject to liquidity, an existing current signal, with limitations on how many can be chosen from each sector. If there are not enough stocks or futures markets that satisfy all the conditions, then the portfolio holds fewer assets. In general, these portfolios are high beta, showing higher returns and higher risk, but have had a history of consistently outperforming the broad market index in all traditional measures.

PERFORMANCE BY GROUP

NOTE that the charts show below represent performance “tracking,” that is, the oldest results since are simulated but the returns from 2013 are the systematic daily performance added day by day. Any changes to the strategies do not affect the past performance, unless noted. The system assumes 100% investment and stocks are executed on the open, futures on the close of the trading day following the signals. From time to time we make logic changes to the strategies and show how the new model performs.

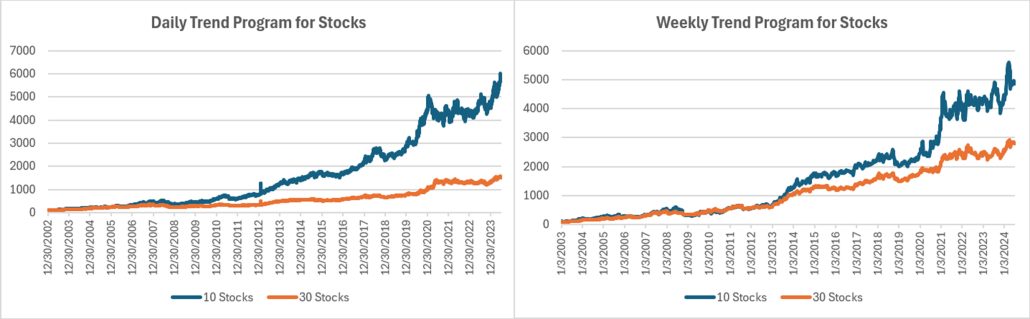

Groups DE1 and WE1: Daily and Weekly Trend Program for Stocks, including Income Focus, DowHedge, Sector Rotation, and the New High-Risk Portfolio

The Trend program seeks long-term directional changes in markets and the portfolios choose stocks that have realized profitable performance over many years combined with good short-term returns. It will hold fewer stocks when they do not meet our condition and exit the entire portfolio when there is extreme risk or a significant downturn.

Equity Trend

An unusual month for the Equity Trend program, with the Daily performance higher and the Weekly lower. Given the history, that should change. During a trending period, the Weekly will hold the trade longer, making it the more desirable. It’s another sign of the inconsistency of this market.

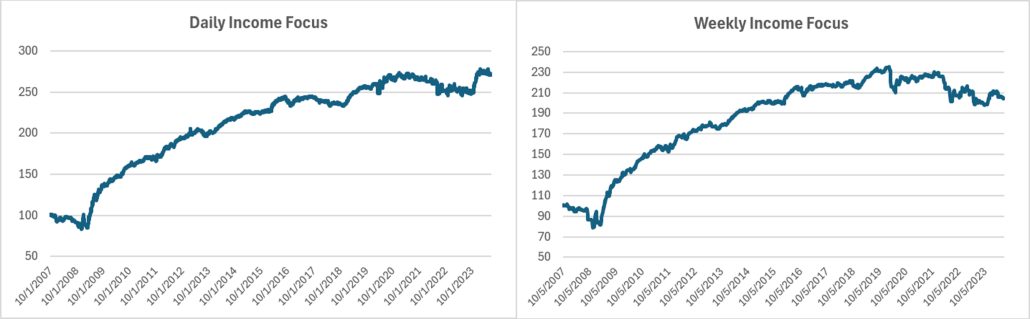

Income Focus and Sector Rotation

Similar returns in both the Daily and Weekly Income Focus, fractionally lower for June. This is another case of the Daily program begin more responsive to interest rate changes. Similar to the Weekly Trend program, a sustained trend will favor the Weekly.

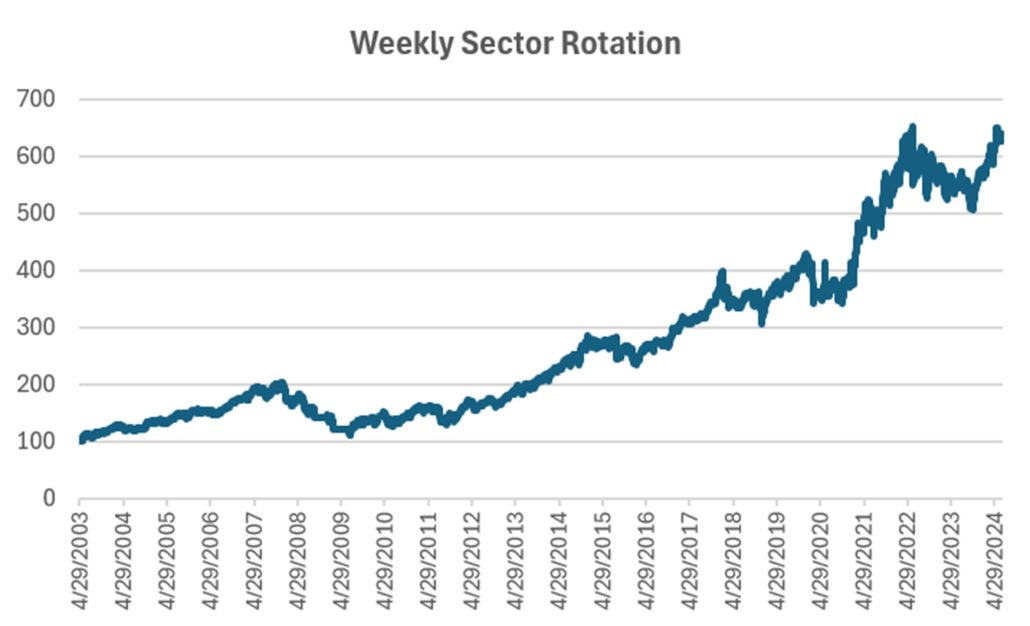

Sector Rotation

Holding the same positions as last month, the Weekly Sector Rotation program lost more that 2% but holds nearly a 10% gain for the year, lower than the S&P but more than the DOW.

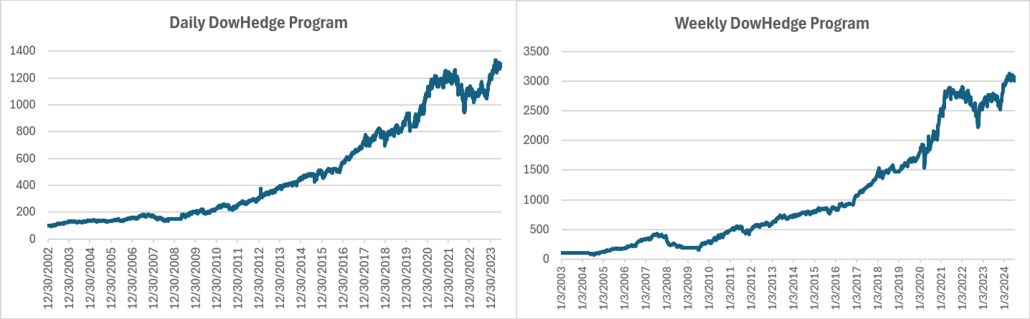

DowHedge Programs

Fractional gains in the Daily program and fractional losses in the Weekly program seems to be consistent with the other daily and weekly programs. Charts remain virtually the same as last month.

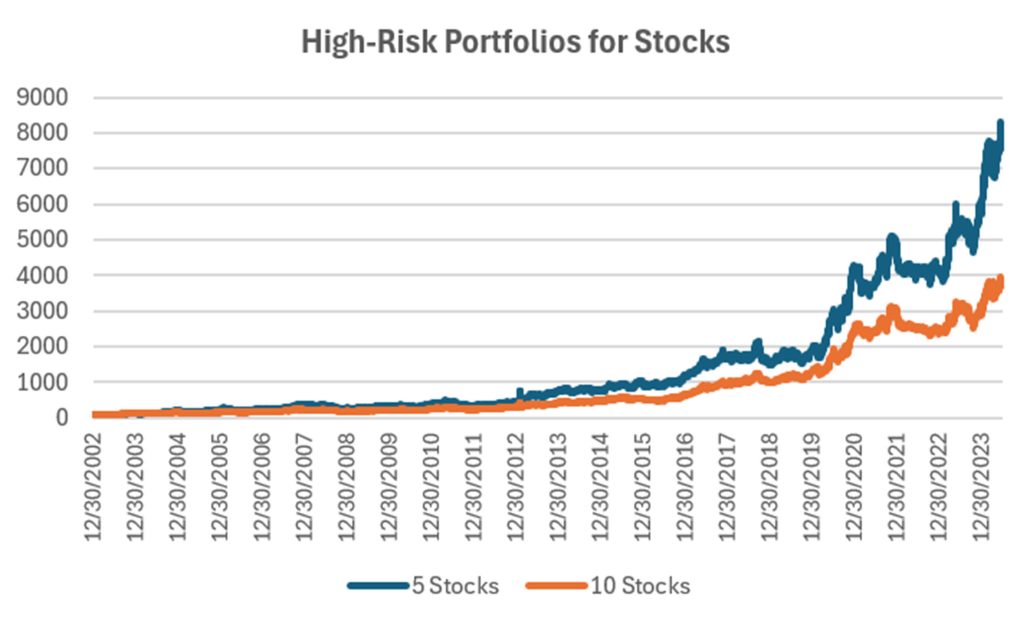

High-Risk Portfolios

Although this program started in February, it has the best returns for the year, even with a larger drawdown. Usually, the smaller portfolio does consistently better than the larger one, but in June the 10 stock was well ahead of the 5 stock, both portfolios gaining.

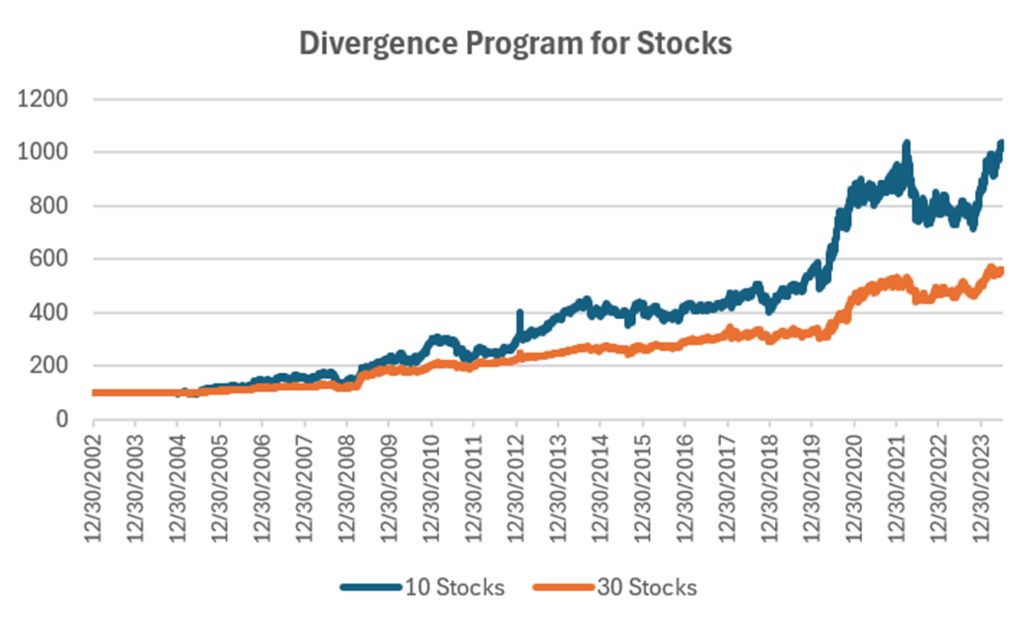

Group DE2: Divergence Program for Stocks

The Divergence program looks for patterns where price and momentum diverge, then takes a position in anticipation of the pattern resolving itself in a predictable direction, often the way prices had moved before the period of uncertainty.

This program has another good month, well ahead of its long- term performance. Trying to capture turns in the market must be a good strategy when there is no lasting trend. The 10-stock portfolio is now ahead of the S&P and Nasdaq for 2024.

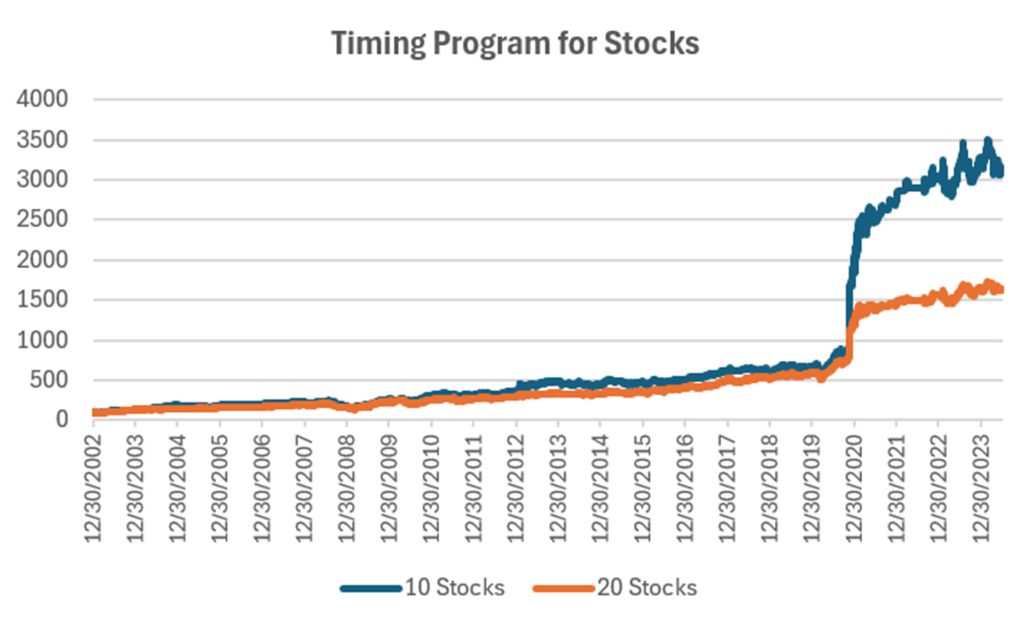

Group DE3: Timing Program for Stocks

The Timing program is a relative-value arbitrage, taking advantage of undervalued stocks relative to its index. It first finds the index that correlates best with a stock, then waits for an oversold indicator within an upwards trend. It exits when the stock price normalizes relative to the index, or the trend turns down. These portfolios are long-only because the upwards bias in stocks and that they are most often used in retirement accounts.

Fractional gains and losses for June seems to be the way this program is going. It requires a trend and a pullback, something that is clearly not happening so far this year. When it does, this program tends to capitalize on it. I am ever hopeful!

Futures Programs

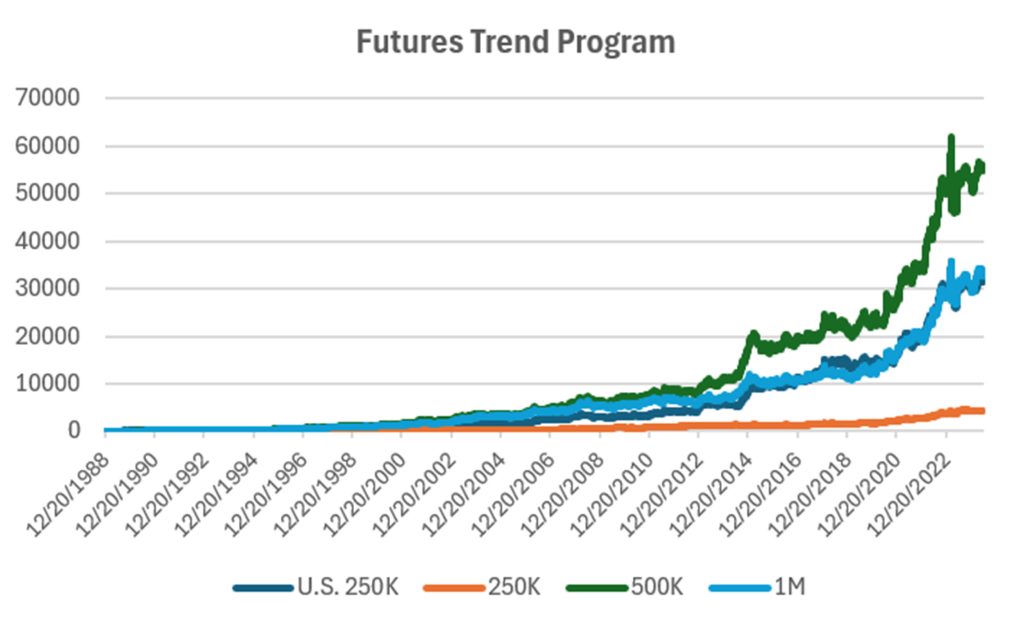

Groups DF1 and WF1: Daily and Weekly Trend Programs for Futures

Futures allow both high leverage and true diversification. The larger portfolios, such as $1million, are diversified into both commodities and world index and interest rate markets, in addition to foreign exchange. Its performance is not expected to track the U.S. stock market and is a hedge in every sense because it is uncorrelated. As the portfolio becomes more diversified its returns are more stable.

The leverage available in futures markets allows us to manage the risk in the portfolio, something not possible to the same degree with stocks. This portfolio targets 14% volatility. Investors interested in lower leverage can simply scale down all positions equally in proportion to their volatility preference. Note that these portfolios do not trade Asian futures, which we believe are more difficult for U.S. investors to execute. The “US 250K” portfolio trades only U.S. futures.

A small gain in the U.S 250K and losses in the other portfolios show that no trend has surfaced yet. In the long history of futures performance, interest rates top the list. Futures funds often have as much as 50% allocated to interest rates. However, this year that doesn’t help. Most of our portfolios have gains for 2024, but far lower than we hoped.

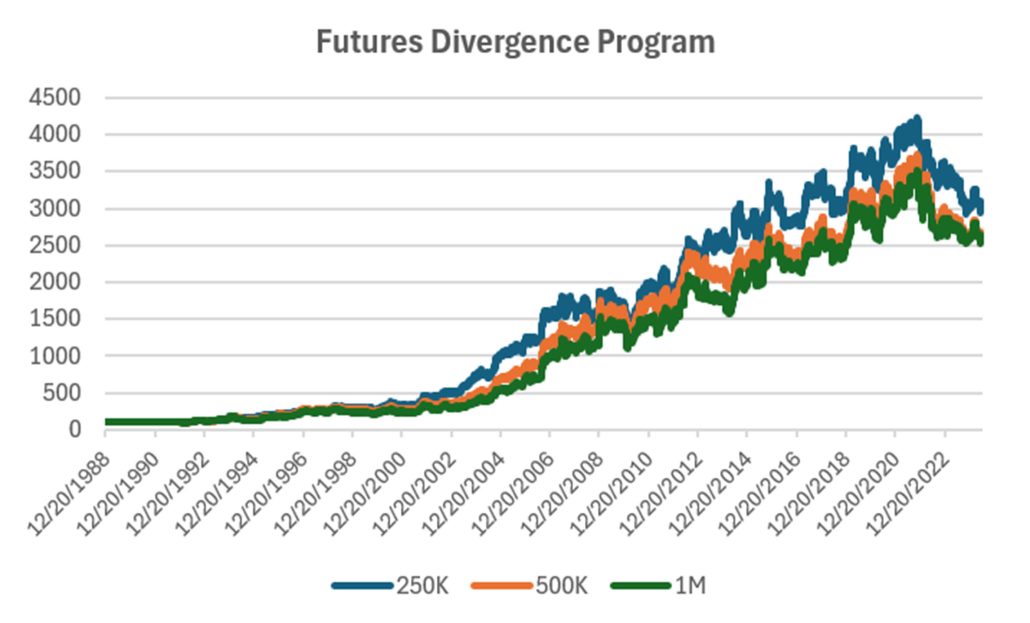

Group DF2: Divergence Portfolio for Futures

Mostly fractional gains in the Futures Divergence program. Only the 250K portfolio has year-to-date gains while the others are near break-even. This program requires a trend to capture the period where the trend stalls. Without a trend this year, nothing seems to be happening.

Blogs and Recent Publications

Perry’s books are all available on Amazon or through our website, www.kaufmansignals.com.

June 2024

Perry was interviewed on June 27th by Simon Mansell and Richard Brennan at QuantiveAlpha (Queensland, Australia), a website heavy into technical trading. It should be posted in a week or so.

“Trading Extreme Gaps and Extreme Closes” looks at daily patterns in stocks, published in the June edition of Technical Analysis.

May 2024

In the April edition of Technical Analysis, Perry again deals with risk in “How Professional Assign Risk.” It is another chapter in how to protect yourself.

April 2024

Another article in the April edition of Technical Analysis, “Determining Risk Before It Happens.” Perry thinks this is an article everyone should read.

March 2024

In the 2024 Bonus Issue of Technical Analysis, Perry has an article, “Pros and Cons of Daily Versus Weekly Trend Following.” There is also a quote by him in the “Retrospective: Interviews” going back to April 1988.

Perry also posted an article on Seeking Alpha, “How To Exit a Trade.” A good reminder of the choices.

February 2024

Perry published an article on using the backwardation and contango in crude oil in “The Delta-Delta Strategy.” If not crude, the you might think of this for any commodity, including interest rates, that have a consistent term structure.

January 2024

A new article in February edition of Technical Analysis of Stocks & Commodities, “Crossover Trading: Arbitrating the Physical with the Stock.” A chance at diversification!

Perry posted 3 new articles on Seeking Alpha in December, “Where Do You Take Profits?”, “Is There a Better Day to Enter the Market,” and “Watching January Returns.”

Another article in Technical Analysis of Stocks & Commodities, “Gap Momentum,” another interesting way to identify the trend.

December 2023

Perry posted 3 new articles on Seeking Alpha, “Where Do You Take Profits?”, “Is There a Better Day to Enter the Market,” and “Watching January Returns.”

This month Technical Analysis of Stocks & Commodities published “A Strategy For Trading Seasonal and Non-Seasonal Market.” Turns out that most markets are non-seasonal!

November 2023

Perry posted two articles on Seeking Alpha, “Compression Breakout: Giving a Boost to Your Entries,” and “Volatility: The Second Most Important Indicator.” In addition, he interview Herb Friedman in Technical Analysis of Stocks & Commodities. Herb is a interest rate specialist focusing on low risk investments.

October 2023

In this month’s Technical Analysis of Stocks & Commodities Perry shows how Merger Arb works and how an investor can participate in it. Merger Arb has been the realm of Institutions, but there are opportunities for everyone.

August 2023

Two(!) new articles by Perry in the August issue of Technical Analysis of Stocks & Commodities. The first is a look at how ChatGPT might help traders. It even asks for a computer program to use trend following.

The second article is “Portfolio Risk Dilemma,” where Perry answers the question of whether to let a stock or futures profit run or rebalance, and whether you should do the same for a diversified portfolio.

Older Items of Interest

On April 18th, 2023 Perry gave a webinar to the Society of Technical Analysts (London) on how to develop and test a successful trading system. Check their website for more details, https://www.technicalanalysts.com..

Perry’s webinar on risk, given to the U.K. Society of Technical Analysts, can be seen using the following link: https://vimeo.com/708691362/04c8fb70ea

For older articles please scan the websites for Technical Analysis of Stocks & Commodities, Modern Trader, Seeking Alpha, ProActive Advisor Magazine, and Forbes. You will also find recorded presentations given by Mr. Kaufman at BetterSystemTrader.com, TalkingTrading.com, FXCM.com, systemtrade.pl, the website for Alex Gerchik, Michael Covel’s website, TrendFollowing.com, and Talking Trading.com.

You will also find up to six months of back copies of our “Close-Up” reports on our website, www.kaufmansignals.com. You can address any questions to perry@kaufmansignalsdaily.com.

© June 2024, Etna Publishing, LLC. All Rights Reserved.