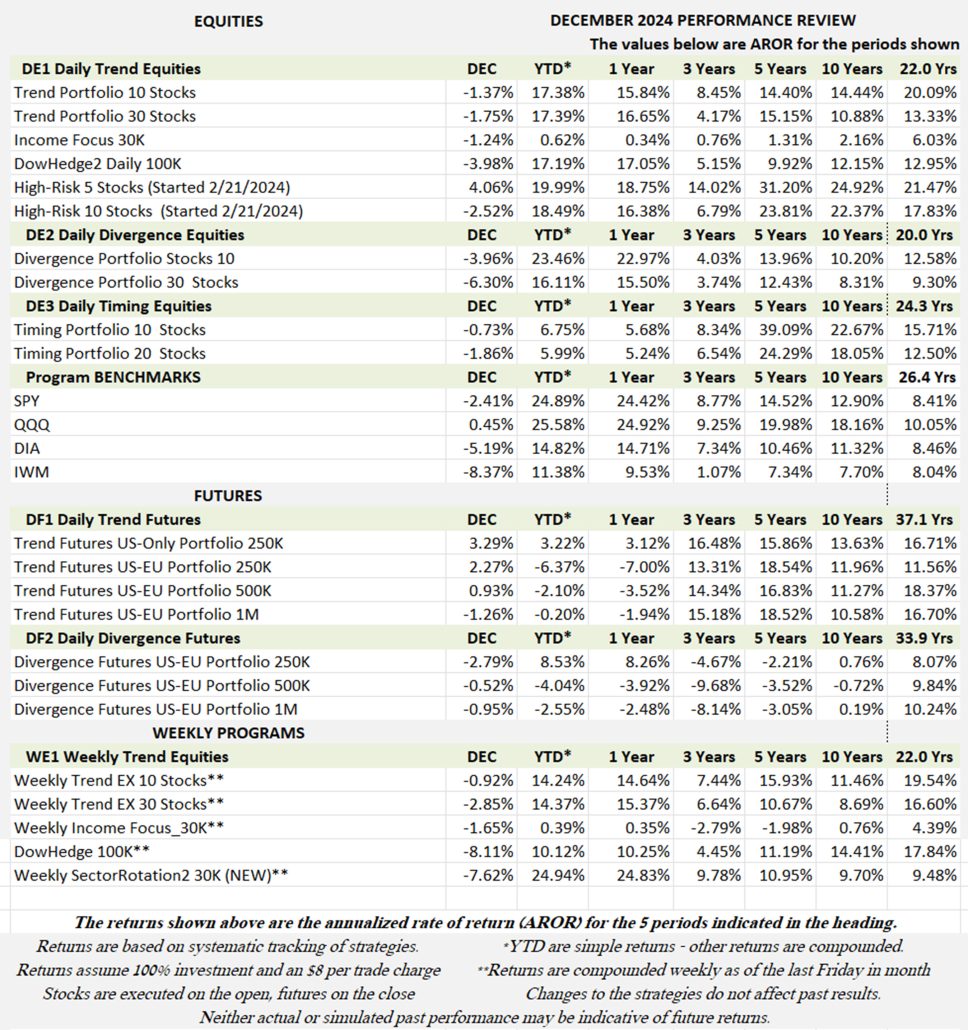

Industry Benchmark Performance

A remarkable year of ups and downs, but in the end, returning 25% in SPY. It started with microchips, in particular Nvidia, then the software companies that embraced artificial intelligence (AI), followed by a drop in enthusiasm, then stimulated again by the election. An interesting roller coaster. All the while, we had biotech competing for weight-loss drugs. Well, that’s better than Covid.

Unless you traded cocoa, and exited at the top, futures disappointed this year. I’ve said before that futures funds rely on interest rate profits, and this year the scenario kept changing. Now it’s not clear how much lower rates will go.

Source: BarclayHedge Indices.

Kaufman’sMost Popular Books (available on Amazon)

Trading Systems and Methods, 6th Edition. The complete guide to trading systems, with more than 250 programs and spreadsheets. The most important book for a system developer.

Kaufman Constructs Trading Systems. A step-by-step manual on how to develop, test, and trade an algorithmic system.

Learn To Trade. Written for both serious beginners and practiced traders, this book includes chart formations, trends, indicators, trading rules, risk, and portfolio management. You can find it in color on Amazon.

You can also find these books on our website, www.kaufmansignals.com.

Blogs and Recent Publications

Find Mr. Kaufman’s other recent publications and seminars at the end of this report. We post new interviews, seminars, and reference new articles by Mr. Kaufman each month.

December Performance in Brief

Even with the sell-off in the last week of December, returns of 17% are very close to the long-term returns of our equity systems. History shows that a passive investment in the index markets tend towards 8% to 10% annually, so this was an exceptional year for them. Both the S&P and Nasdaq did about the same, but then the S&P has all of the big tech names driving it as well.

Futures were mixed, with some portfolios profitable and some with marginal losses. As said earlier, interest rates drive performance and that was not to be in 2024. We added soft commodities to our portfolio in December. They are not normally liquid enough for our program, but they have gained volume as prices have risen. Perhaps we’ll profit on their way down!

It’s easy to see the sell-off in December after another strong year. Nasdaq continues to lead although the S&P (SPY) is doing well with less volatility. The DOW (DIA) and small caps (IWM) are trading at the same level, which seems remarkable because they have nothing in common. We’re going to look at this 2-year run in the S&P in our Close-Up report next.

Major Equity ETFs

Insert Major Index

CLOSE-UP: Will 2025 Be Better Than 2024?

The Year that Was – My December Retail Choices

With the S&P off nearly 3% in December, few of my choices proved to be profitable. Amazon and Apple were both higher. Of the five stocks that I recommended to avoid, only Nordstrom traded higher. Of the 10 stocks covered, 3 were wrong (N), 6 were correct (Y), and 1 was questionable (Q).

Macy’s (M) Y, Nordstrom (JWN) N, Walmart (WMT) Y, BestBuy (BBY) Y, Disney (DIS) N,

MGM (MGM) N, Caesar (CZR) N, United Airlines (UAL) Y, Apple (AAPL) Y, Amazon (AMZN) Y.

If you think December performance was strange, the market normally rallies. Given that the stock market performance was strong in 2024, one would think it would carry into December. It shows how unpredictable the stock market can be.

My 65% Forecast

Given my success in December of about 65%, I’m going to set the stage for 2025.

Watching the financial news each day, we need to weight the following factors:

- Are there going to be tariffs?

- Will there be pressure on the Fed to lower rates?

- Will there be deregulation?

- How will oil be affected? And the climate?

- How will deporting immigrants change our economy?

- Will Bird Flu become the next pandemic?

Can we put this together to decide on both the U.S. dollar and inflation. If we can do that, the rest will follow.

Tariffs

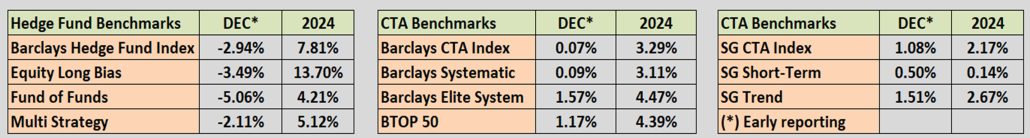

The last tariffs in February 2022 caused the market to sell off 35% quickly. And that was just China. Tariffs are taxes on U.S. citizens. It raises prices on goods and depletes spending power. The market realizes its affects and stock prices decline.

The new administration is now talking about tariffs on China, Mexico, and Canada. That would be much worse. Is it likely to happen? Probably not. If the conversation is not stopped, there is no doubt that it will cause volatility. If they go ahead, we could see a worse decline than in 2020.

Chart 1. The stock market fell 35% on the announcement of tariffs on Chinese goods.

Immigration

Yes, immigration is a problem. We have good families immigrating, getting jobs that U.S. workers don’t want, and paying taxes from which they will never get benefits. That helps our economy.

Then there are the bad players that scam our system (oh, we have U.S. citizens that do that also!).

Who will the administration deport? The good guys who they can see. The bad guys are not going to be easy to find.

What happens when we deport the farm and factory workers? Food could become scarce, prices will rise. Not hard to figure that out. Will it actually happen? The administration may start the process but it’s not likely that it will get far. Too costly, too many pollical issues, and too disruptive.

Bird Flu

Covid was a disaster for our economy. Maybe not for the biotech industry, that came to the rescue. Early on we tracked Covid. Initially the experts said “Not to worry. Only a few people have it.” Now that we have transmission from birds to people, you would think the NIH would learn from their errors.

Chart 2 shows the initial decline in stocks once we recognized that Covid was not going away. I can’t say that Bird Flu has the same potential, but it is on the radar.

Chart 2. The beginning of Covid’s effect on the economy.

Deregulation

The current administration plans deregulation, as it did in its previous term. I must admit that we have a lot of regulations, some good, some a bit too much. But then there are a lot of bad players in our society, and regulation limits their effect on the total population.

How much is too much? I have no idea. But encouraging more oil production may not be in the interest of either the population or the energy companies. Energy companies have been moving towards greener solutions and making a profit. I don’t see a lot of changes.

Allowing more crypto “currencies?” While I think that cryptos have no basis in economics (at this point), it seems that traders/speculators can do what they want with their money. After all, they can bet on sports, the Fed interest rate decisions, and much more. As long as they are not cheated. Regulation helps.

Electricity

Artificial Intelligence (is that an oxymoron?) and cryptos take a lot of energy. That’s going to be a problem. There is a new push towards restoring nuclear energy, which is abundant and cheap. The only problem is the radioactive waste. It would be nice if someone figured out how to dispose of it safely.

Interest Rates

Trading interest rates has been the most profitable sector for Futures Funds. Up to this year.

For the past 40 years, rates have come down. Covid caused a supply chain problem that changed that. Because inflation jumped, the Fed raised rates with the target of 2% inflation. That doesn’t mean that prices will come down, it only means they won’t go up as fast.

But the talk in the new administration of tariffs has caused the Fed to stop lowering rates, or at least target a higher stopping point, perhaps 3% or 4% rather than a lower rate. That can keep the U.S. dollar strong as long as it doesn’t affect growth and retail sales. But other countries will have the same problem. We can’t count on interest rates to bail out the futures funds.

Stocks

Two years of outstanding gains? Can there be a third? Yes, but with high volatility given all the uncertainty. And which sectors will be the best? Difficult to know unless you have a stock selection program. As we just said, don’t count on interest rates. Trading the S&P is likely to be the safest.

Futures

Futures are a good way of judging the economy. They have high volume and are separated in economic “sectors.” This year, the biggest movements were in the “soft” commodities.

- Cocoa (CC) ranged from 4260 to 11539, a gain of 70%. With normal futures margin that can be a lot. But volume is generally low, so traders need to be careful. It can be a case of “easy to enter, hard to exit.”

Chart 3. Cocoa futures, 2024.

- Coffee (KC) was also on the rise from 186 to 323, steady but with a jump after the election.

- Orange juice (OJ) was straight up all year. My only concern is that imports from South America can offset that rise.

Chart 4. Orange juice futures, 2024.

- Cotton (CT) rallied from 80 to 105, then dropped to 70. A good move if you can follow it.

- U.S. grains, corn and soybeans were sideways, but at better prices historically.

- EUR/USD (euro) ranged from 111 to 103 but has fallen off after the election.

Chart 5. EUR/USD foreign exchange futures, 2024.

- 10-Year Notes (ZN) has had a wide range but no long-term trend.

Chart 6. U.S. 10-Year Notes, 2024.

Conclusion

There are a lot of contrasting factors. You would need to be a better forecaster than I am to figure this out. However, it all leads to volatility. That means you need to pay attention to risk.

As for making money in stocks, a normal position in the S&P or Nasdaq seems best. Over the long run, stocks have performed. Some sectors have been better than others, but by trading the S&P you can avoid that decision.

In futures I expect interest rates to go no lower than 3%, perhaps even 4%, unless the administration puts pressure on the Fed. That doesn’t seem likely unless the economy falters. Then the Fed will act anyway. The pattern to 3% or 4% will be erratic.

I don’t expect tariffs to happen to any great degree, certainly not with Mexico and Canada. Perhaps China. But more likely with electric cars, such as BYD which compete with Tesla and Musk. However, there might be a “to-do” before it is all settled.

Those are my best guesses. Take them with a grain of salt.

A Standing Note on Short Sales

Note that the “All Signals” reports show short sales in stocks and ETFs, even though short positions are not executed in the equity portfolios. Our work over the years shows that downturns in the stock market are most often short-lived and it is difficult to capture with a longer-term trend. The upwards bias also works against shorter-term systems unless using futures, which allows leverage. Our decision has been to take only long positions in equities and control the risk by exiting many of the portfolios when there is extreme volatility and/or an indication of a severe downturn.

PORTFOLIO METHODOLOGY IN BRIEF

Both equity and futures programs use the same basic portfolio technology. They all exploit the persistence of performance, that is, they seek those markets with good long-term and short-term returns on the specific system, rank them, then choose the best, subject to liquidity, an existing current signal, with limitations on how many can be chosen from each sector. If there are not enough stocks or futures markets that satisfy all the conditions, then the portfolio holds fewer assets. In general, these portfolios are high beta, showing higher returns and higher risk, but have had a history of consistently outperforming the broad market index in all traditional measures.

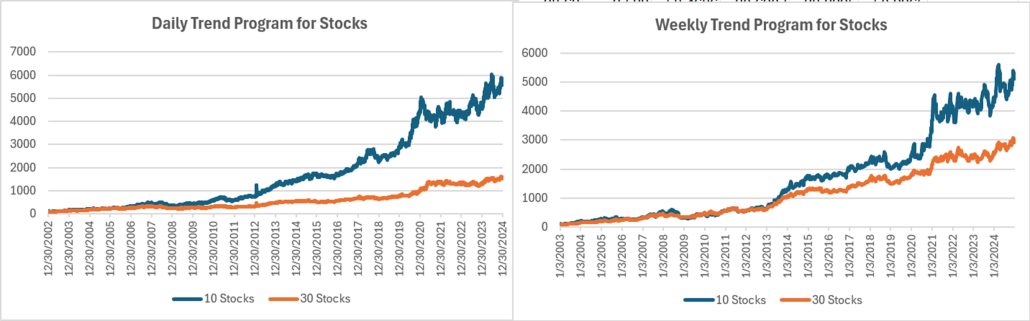

PERFORMANCE BY GROUP

NOTE that the charts show below represent performance “tracking,” that is, the oldest results since are simulated but the returns from 2013 are the systematic daily performance added day by day. Any changes to the strategies do not affect the past performance, unless noted. The system assumes 100% investment and stocks are executed on the open, futures on the close of the trading day following the signals. From time to time we make logic changes to the strategies and show how the new model performs.

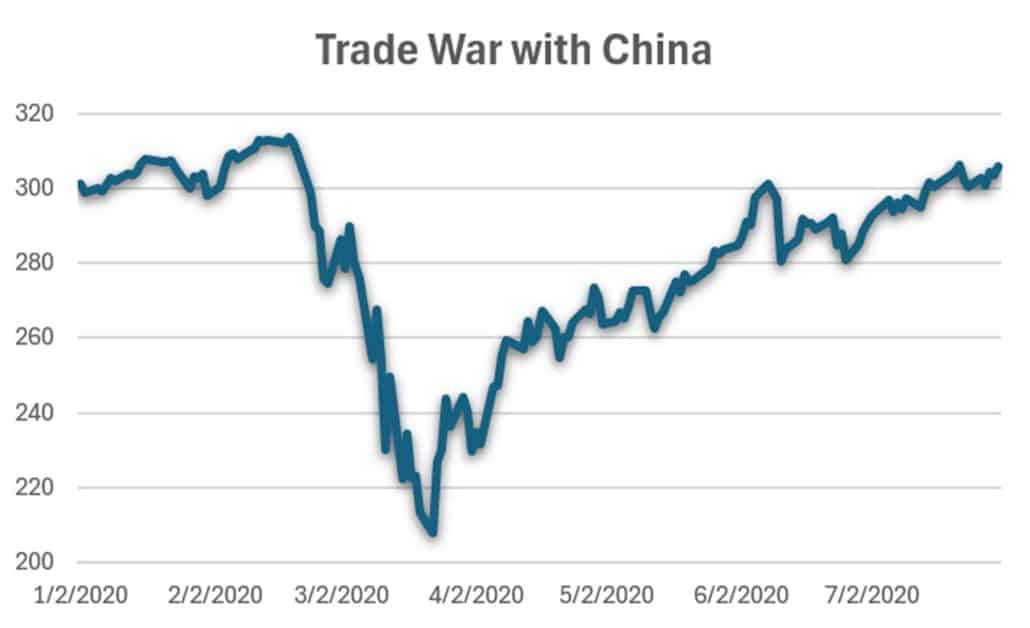

Groups DE1 and WE1: Daily and Weekly Trend Program for Stocks, including Income Focus, DowHedge, Sector Rotation, and the New High-Risk Portfolio

The Trend program seeks long-term directional changes in markets and the portfolios choose stocks that have realized profitable performance over many years combined with good short-term returns. It will hold fewer stocks when they do not meet our condition and exit the entire portfolio when there is extreme risk or a significant downturn.

Equity Trend

The sell-off at the end of December left this program with gains of about 17% for 2024, slightly under its long-term performance. While its progress had periods of high volatility, it continued to shift to the best markets. Even now, the portfolios hold less than 50% in high-tech stocks.

The Weekly Portfolios retained some of its early returns, finishing up 14%, off from its long-term performance of 16% to 19%, but still good. The Weekly program does better when the market trends, but this year that was elusive.

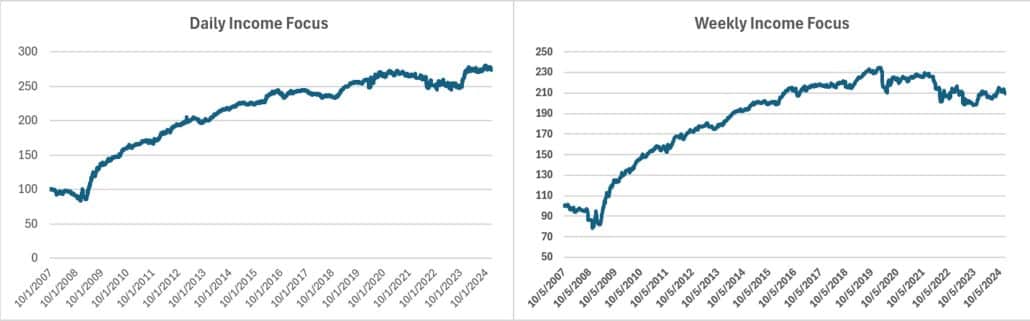

Income Focus and Sector Rotation

It’s hard to make money when your focus is on declining interest rates. This program eked out a tiny profit in both the daily and weekly portfolios. That seems to be the best scenario given the inconsistency of interest rates. Still, we expect rates to go lower, perhaps not as much as we would like, but enough to generate some gains in this strategy.

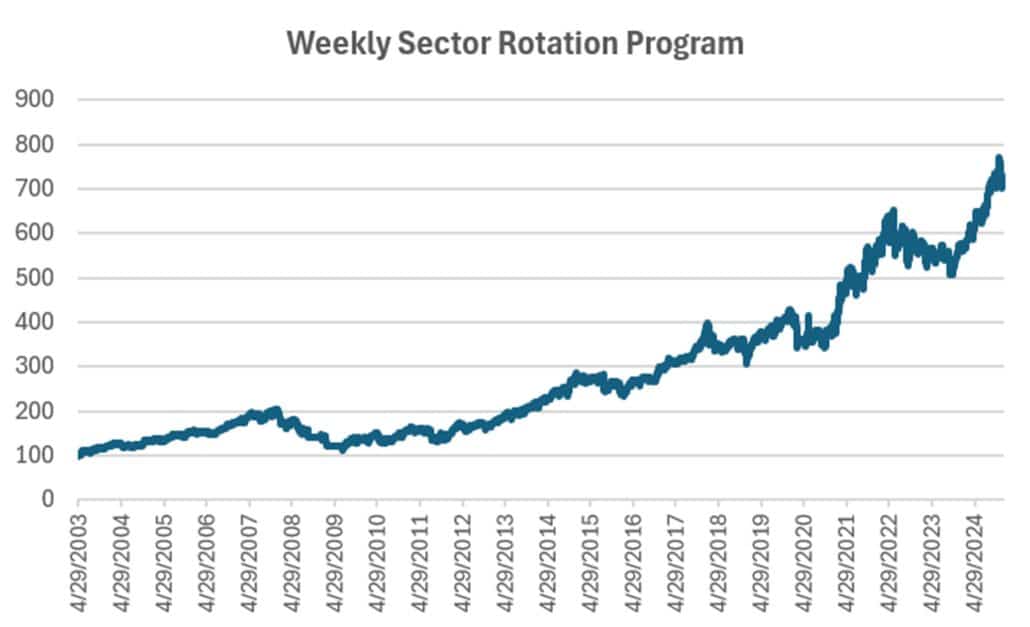

Weekly Sector Rotation

This program took a 7.6% loss in December but still returned nearly 25% for the year. I would call this a “sleeper.” It held the same positions for nearly all year, while the overall market flopped from one news article to the next.

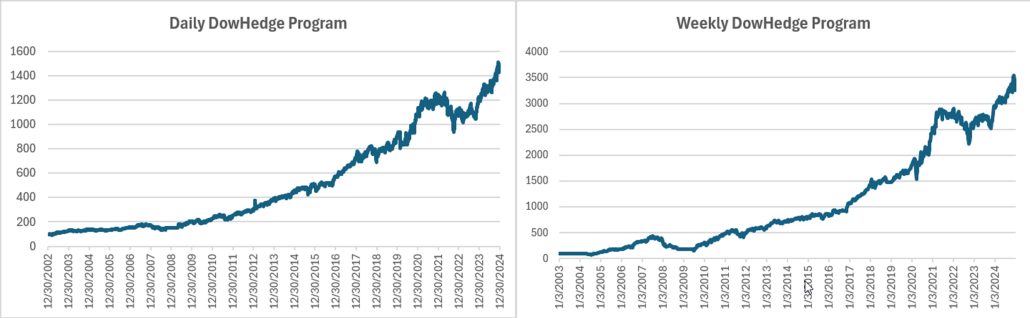

DowHedge Programs

As with other programs, the DowHedge lost in December but gained 17% in the daily portfolio and 10% in the weekly portfolio. The Daily was better than the DOW index and the Weekly a bit lower. However, the program avoided the drawdowns, which is part of its profile.

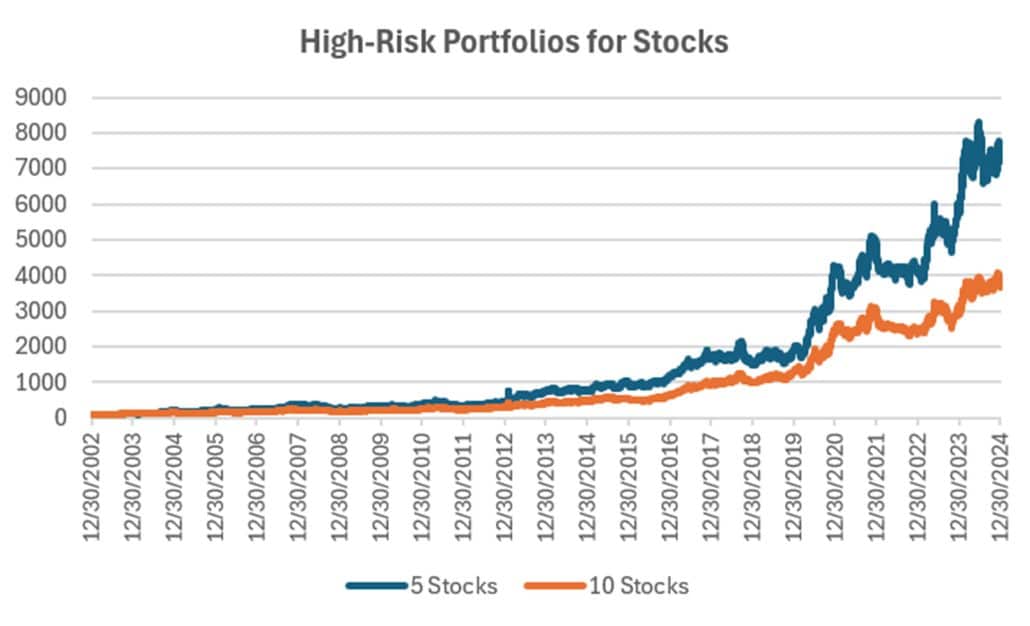

High-Risk Portfolios

Our latest program finished mixed in December, with the 5-stock portfolio higher by 4%, and the 10-stock lower by 2.5%. Still, both finished the year up by 20% and 18%. A strange year for this high-risk stocks, but rumor has it they will do better in 2025.

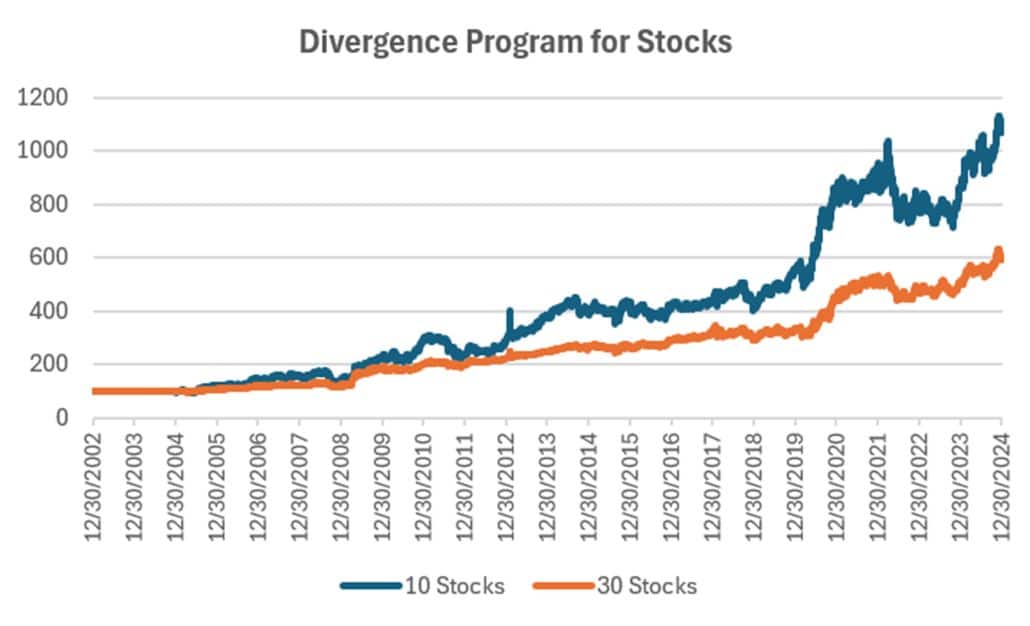

Group DE2: Divergence Program for Stocks

The Divergence program looks for patterns where price and momentum diverge, then takes a position in anticipation of the pattern resolving itself in a predictable direction, often the way prices had moved before the period of uncertainty.

A good year for the Divergence program, even with modest losses in December. Gains of 23% and 16% are well above its long-term returns. Given that this program needs a pause in a trending market, I’m not sure where those trends were… as long as the system knows!

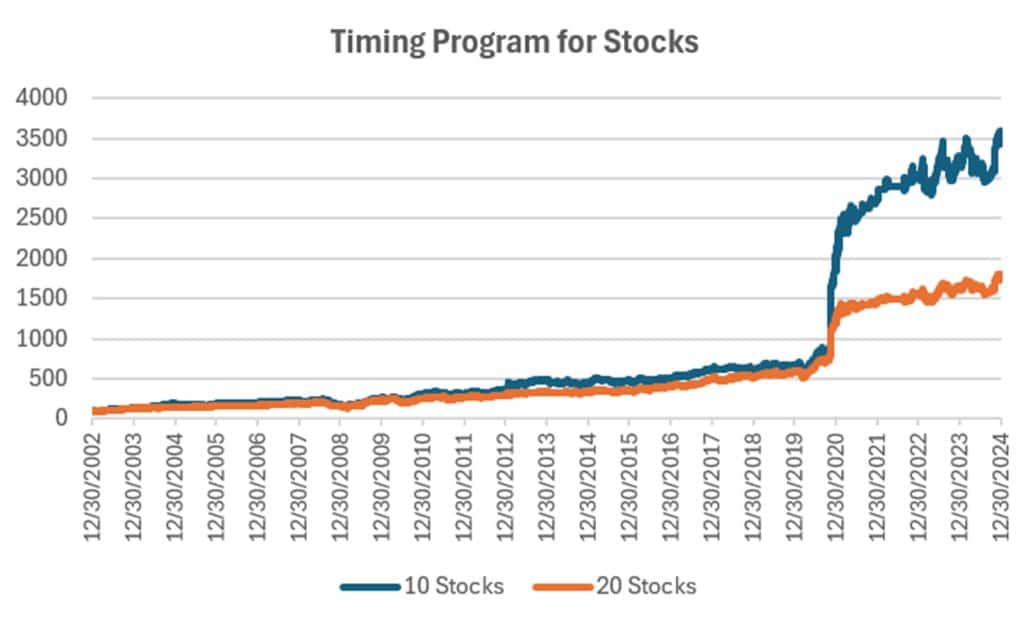

Group DE3: Timing Program for Stocks

The Timing program is a relative-value arbitrage, taking advantage of undervalued stocks relative to its index. It first finds the index that correlates best with a stock, then waits for an oversold indicator within an upwards trend. It exits when the stock price normalizes relative to the index, or the trend turns down. These portfolios are long-only because the upwards bias in stocks and that they are most often used in retirement accounts.

Even with underperformance in 2024, I am encouraged by the returns of the Timing program. It has small losses in December and a modest gain for 2024 of about 6%. It kept losses low and still was profitable in a market where it needs a pullback in a trend. It is sitting at all-time highs, and trends this coming year might give it the needed boost.

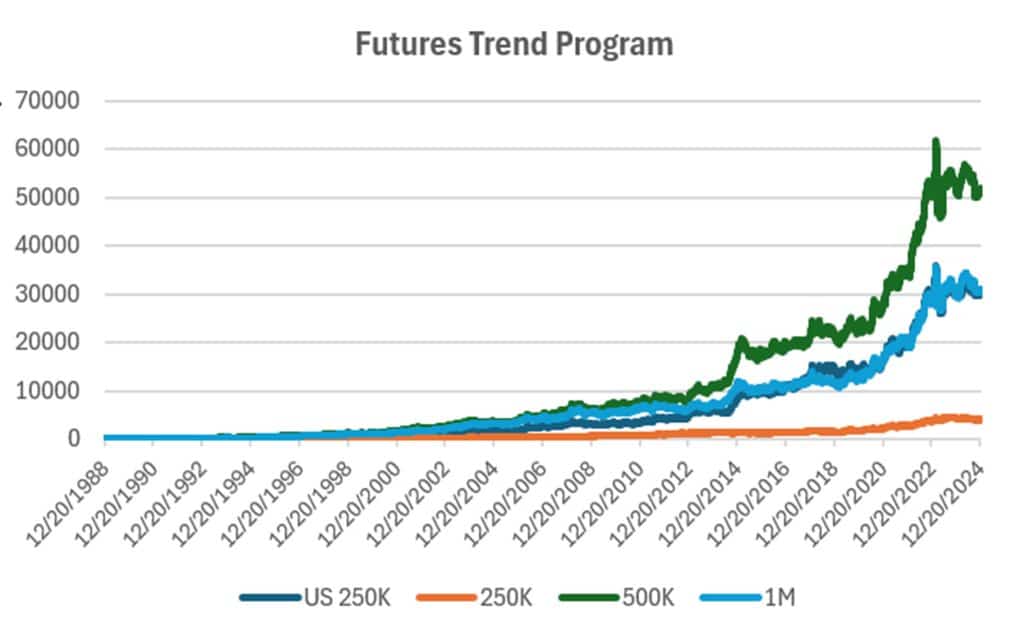

Futures Programs

Groups DF1: Daily Trend Programs for Futures

Futures allow both high leverage and true diversification. The larger portfolios, such as $1million, are diversified into both commodities and world index and interest rate markets, in addition to foreign exchange. Its performance is not expected to track the U.S. stock market and is a hedge in every sense because it is uncorrelated. As the portfolio becomes more diversified its returns are more stable.

The leverage available in futures markets allows us to manage the risk in the portfolio, something not possible to the same degree with stocks. This portfolio targets 14% volatility. Investors interested in lower leverage can simply scale down all positions equally in proportion to their volatility preference. Note that these portfolios do not trade Asian futures, which we believe are more difficult for U.S. investors to execute. The “US 250K” portfolio trades only U.S. futures.

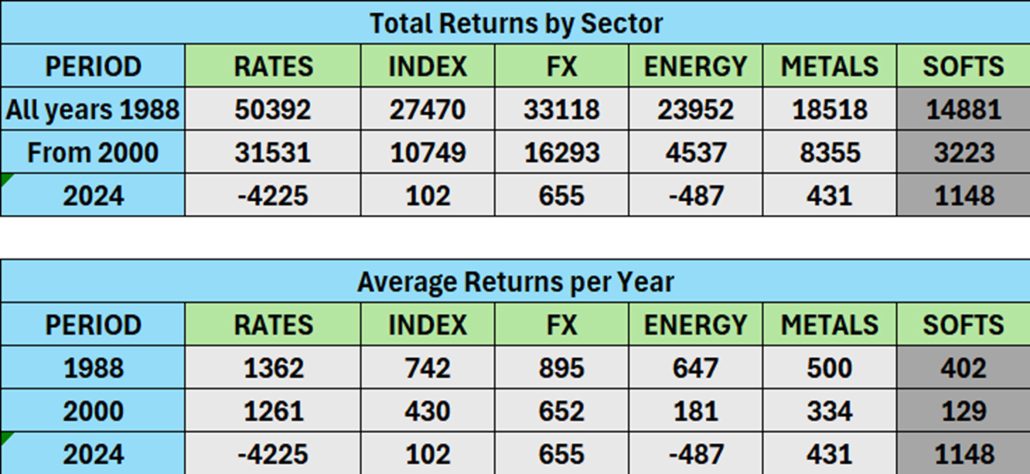

2024 Performance by Sector

To understand the performance of our program in 2024, the following table shows how this year is an outlier given past performance.

Futures Performance by Sector 2024

Futures tend to perform when equities fall. This year that didn’t happen. There was no trend in interest rates, which is normally the best performer for futures. Instead it was cocoa, generally too thin to trade. However, we added soft commodities in December and may benefit as prices come down (as they usually do). High prices have increased volume to make some of the soft commodities worth trading.

In 2024, only our U.S. 250K portfolio has some profits, while the others portfolios had modest losses.

In our “Close-Up” above, we showed the performance of our system in commodity sectors. Uncertainty seems to be the overriding event. We are looking forward to something better in 2025.

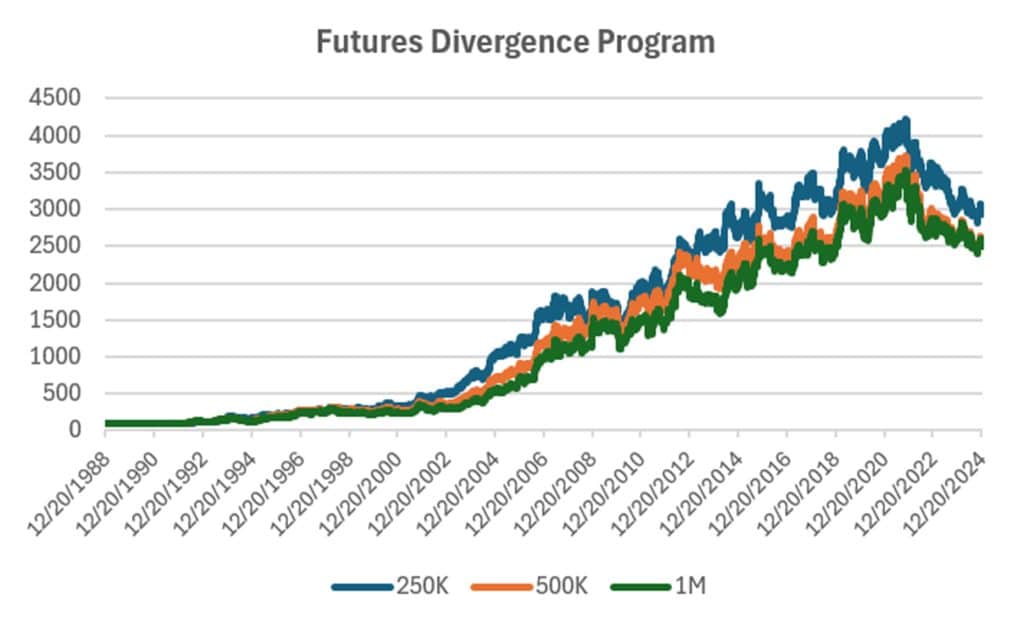

Group DF2: Divergence Portfolio for Futures

A long downward trend in the Divergence program doesn’t seem to go away, even with an 8% gain for 2024 in the smallest U.S. 250K portfolio. The other porfolios had modest losses for the year. We still believe this program offers good diversification and expect 2025 to prove it.

Blogs and Recent Publications

Perry’s books are all available on Amazon or through our website, www.kaufmansignals.com.

November 2024

“Overlooked Strategy Rules” appeared in the December issue of Technical Analysis of Stocks & Commodities. We tend to overlook certain rules that can make a big difference to results. This article looks at scaling in and scaling out of a position, delayed entries, correlations, and other simple but important rules.

October 2024

“Trading a Breakout System” was published in Technical Analysis of Stocks & Commodities. It looks at whether it’s better to enter on the bullish breakout, wait for confirmation, or buy ahead of the breakout. It’s a practical look at improving breakout results.

September 2024

Two articles posted by Perry, “The N-Day or the Swing Breakout,” (Technical Analysis of Stocks & Commodities) looking to see which is better. You would be surprised.

A look at deleveraging Artificial Intelligence stocks, a shorter version of the article posted in our “Close-Up” section. It appeared in Seeking Alpha earlier in September.

August 2024

“Theory Versus Reality” was published in the August issue of Technical Analysis of Stocks & Commodities. It discusses price shocks, diversification, predicting performance, and more.

July 2024

Perry posted a new article on Seeking Alpha, “Capturing Fund Flows.” It a good strategy for someone that wants to add some diversification. It only trades 3 days each month!

June 2024

Perry was interviewed on June 27th by Simon Mansell and Richard Brennan at QuantiveAlpha (Queensland, Australia), a website heavy into technical trading. It should be posted in a week or so.

“Trading Extreme Gaps and Extreme Closes” looks at daily patterns in stocks, published in the June edition of Technical Analysis.

May 2024

In the April edition of Technical Analysis, Perry again deals with risk in “How Professional Assign Risk.” It is another chapter in how to protect yourself.

April 2024

Another article in the April edition of Technical Analysis, “Determining Risk Before It Happens.” Perry thinks this is an article everyone should read.

March 2024

In the 2024 Bonus Issue of Technical Analysis, Perry has an article, “Pros and Cons of Daily Versus Weekly Trend Following.” There is also a quote by him in the “Retrospective: Interviews” going back to April 1988.

Perry also posted an article on Seeking Alpha, “How To Exit a Trade.” A good reminder of the choices.

February 2024

Perry published an article on using the backwardation and contango in crude oil in “The Delta-Delta Strategy.” If not crude, the you might think of this for any commodity, including interest rates, that have a consistent term structure.

January 2024

A new article in February edition of Technical Analysis of Stocks & Commodities, “Crossover Trading: Arbitrating the Physical with the Stock.” A chance at diversification!

Perry posted 3 new articles on Seeking Alpha in December, “Where Do You Take Profits?”, “Is There a Better Day to Enter the Market,” and “Watching January Returns.”

Another article in Technical Analysis of Stocks & Commodities, “Gap Momentum,” another interesting way to identify the trend.

This month Technical Analysis of Stocks & Commodities published “A Strategy For Trading Seasonal and Non-Seasonal Market.” Turns out that most markets are non-seasonal!

Older Items of Interest

On April 18th, 2023, Perry gave a webinar to the Society of Technical Analysts (London) on how to develop and test a successful trading system. Check their website for more details, https://www.technicalanalysts.com..

Perry’s webinar on risk, given to the U.K. Society of Technical Analysts, can be seen using the following link: https://vimeo.com/708691362/04c8fb70ea

For older articles please scan the websites for Technical Analysis of Stocks & Commodities, Modern Trader, Seeking Alpha, ProActive Advisor Magazine, and Forbes. You will also find recorded presentations given by Mr. Kaufman at BetterSystemTrader.com, TalkingTrading.com, FXCM.com, systemtrade.pl, the website for Alex Gerchik, Michael Covel’s website, TrendFollowing.com, and Talking Trading.com.

You will also find up to six months of back copies of our “Close-Up” reports on our website, www.kaufmansignals.com. You can address any questions to perry@kaufmansignalsdaily.com.

© December 2024, Etna Publishing, LLC. All Rights Reserved.